Investor News

Shareholder Update - Local Activity

Environmental Clean Technologies Limited (ASX: ECT) (ECT or Company) is pleased to provide the following general update on local activities.

Key points:

- Coldry upgrade project – full construction program commenced October

- Capital Management:

- New R&D loan facility established

- Equity Lending Facility (ELF) – expiry of original ELF

- AGM planning

Coldry Upgrade Project

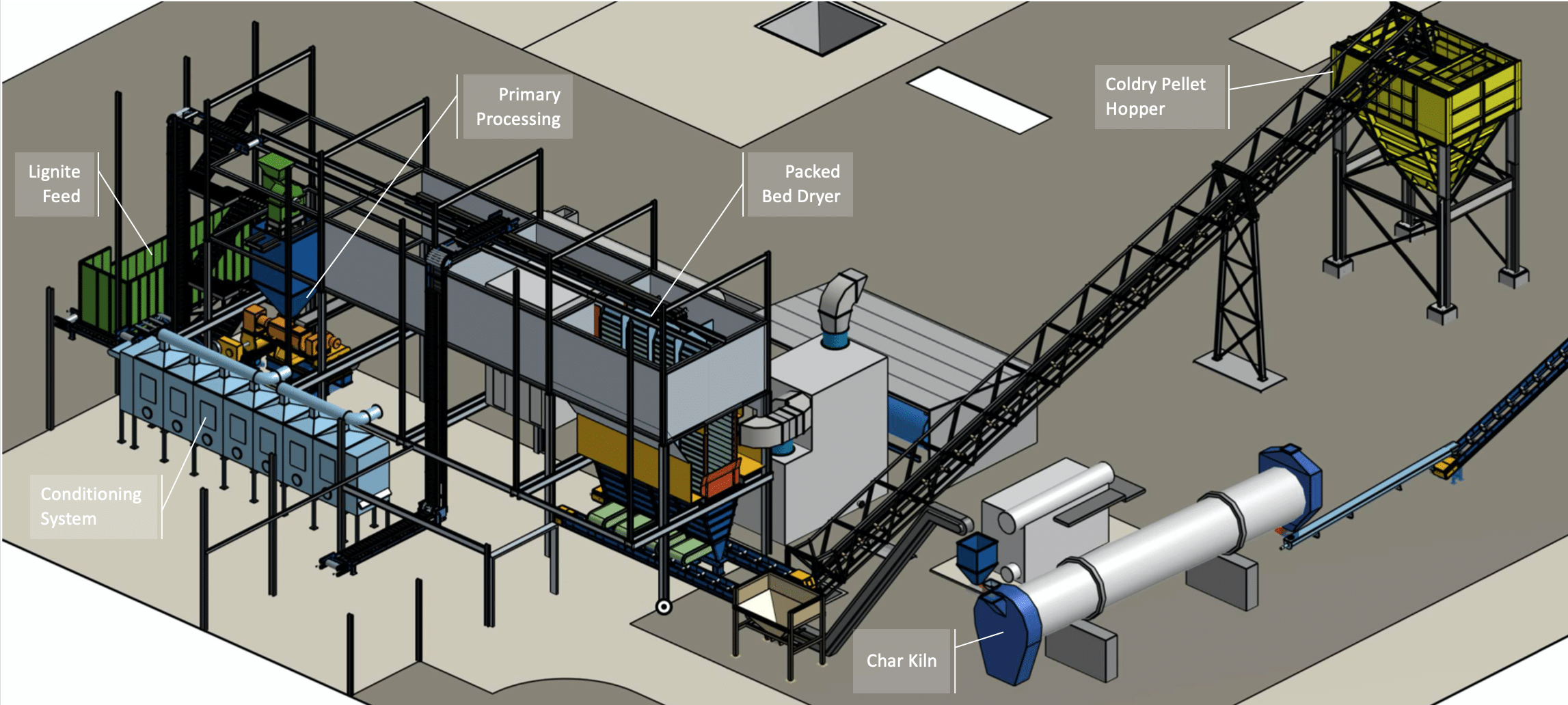

The Coldry upgrade project is comprised of the scale up the Company’s Coldry process and the addition of new plant and equipment to produce high-value char and solid fuel.

These activities are focused on delivery of two key objectives:

- Advancing Coldry development via the small-scale commercial demonstration of the process with a host application

- Achieving positive cashflow: monetising existing assets to deliver up to $2.5 million a year of operating cashflow from target revenues of approximately $6 million

On 17 July 2020 the Company outlined the status of its Coldry upgrade project, noting:

- The completion of the site layout and basic design

- Site preparation works commenced

- Process tender packages issued

The Company is pleased to advise that the construction phase of the project formally commenced on Friday 9 October 2020, with the de-cladding of the main building initiated ahead of installation of plant and equipment as it arrives on site over coming months.

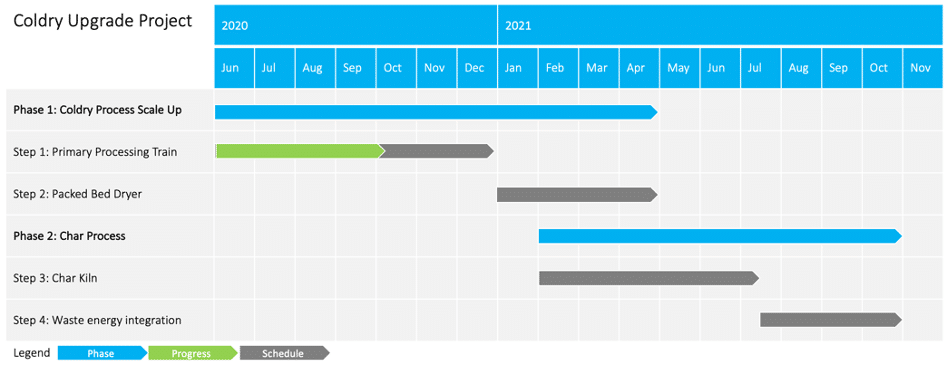

An overview of the target project timeline, updated to reflect the impact of COVID-19, is provided below.

Target Timeline

As previously announced (18 June 2020) the project is divided into two phases.

Phase 1 – Coldry process scale up:

- Design, construction, installation and individual commissioning of each key stage of the process, including primary processing train, conditioning system and drying system

- Integration of the plant and equipment across each key stage of the process to establish continuous, steady state operations

Phase 2 – Char process integration:

- Design, procurement, installation and individual commissioning of the char kiln

- Integration of the char kiln with the Coldry process to establish continuous, steady state operations and waste energy utilisation for drying

By phasing the project in this manner, the Company seeks to mitigate the unpredictable risks associated with the impact of COVID-19 in the context of the well-understood risks associated with the scale up and commercialisation of new technologies. As such, expenditure is limited to the amount needed to reduce the risk of each phase, before proceeding to the next phase with increased technical and financial confidence.

Activity – June to October

Following the return to normal operation on 18 June 2020, the team has undertaken extensive preparation ahead of the recent commencement of construction, including:

- Completion of the site layout and basic design (announced 17 July 2020)

- Procurement

- Pre-construction preparation

Glenn has been overseeing the site management since July, now to be handed over to Scott Vagala (above) as he turns his attention to off-take sales and government funding. Glenn often sleeps overnight on-site in a swag, in the “Chairman’s lounge”.

Procurement

- Development and issue of tender packages (complete)

- Evaluation of tender responses (complete)

- Order placement (complete)

- Receipt & inspection of plant & equipment including:

- Mixer, mill & extruder (all on-site)

- Workshop & laboratory buildings (inspection complete, due for delivery)

- Design and fabrication:

- Lignite feed-in system: design, prototyping and testing of the lignite feed-in system featuring a ‘walking’ floor configuration

- Conditioning system:

- Bespoke, proprietary design

- Local and overseas components

- Local fabrication

Photos (above): With at least 5 full truckloads of lignite to be delivered every day once full operation commences, access points need to be widened and upgraded. Central concreting finishing off the new roadway to allow trucks to more easily enter and exit the lignite storage area.

Pre-Construction Preparation

- WHS compliance

- Licencing and permits

- Policies and procedures

- Hazard management

- Clearing and consolidation of all surplus materials and equipment

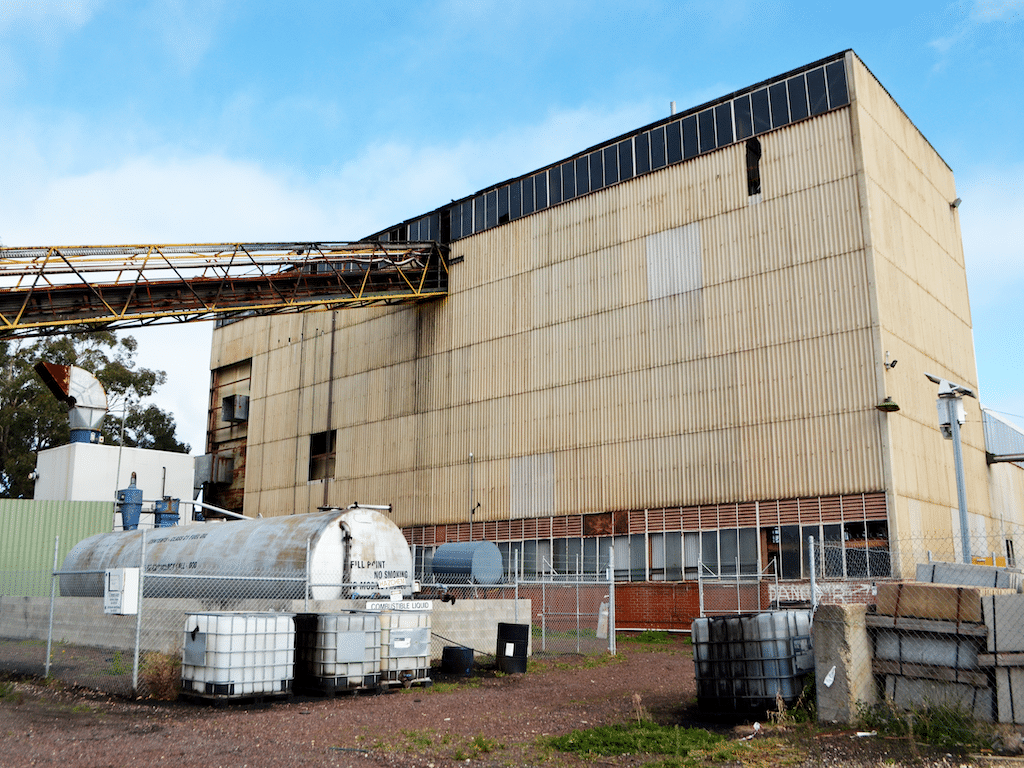

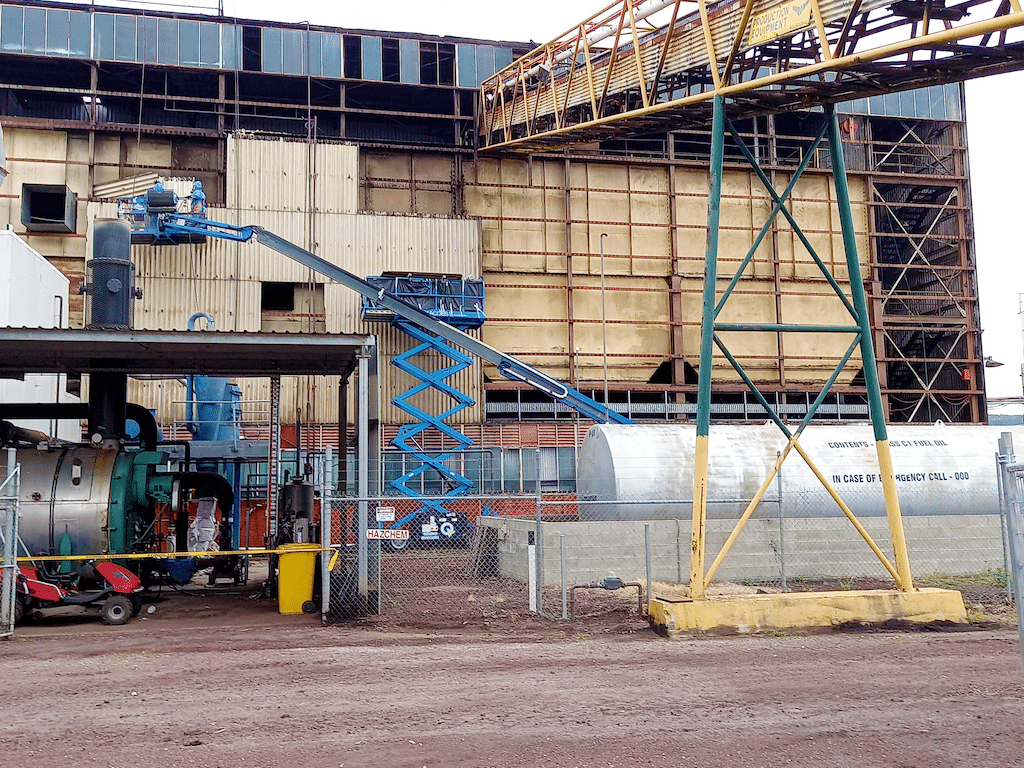

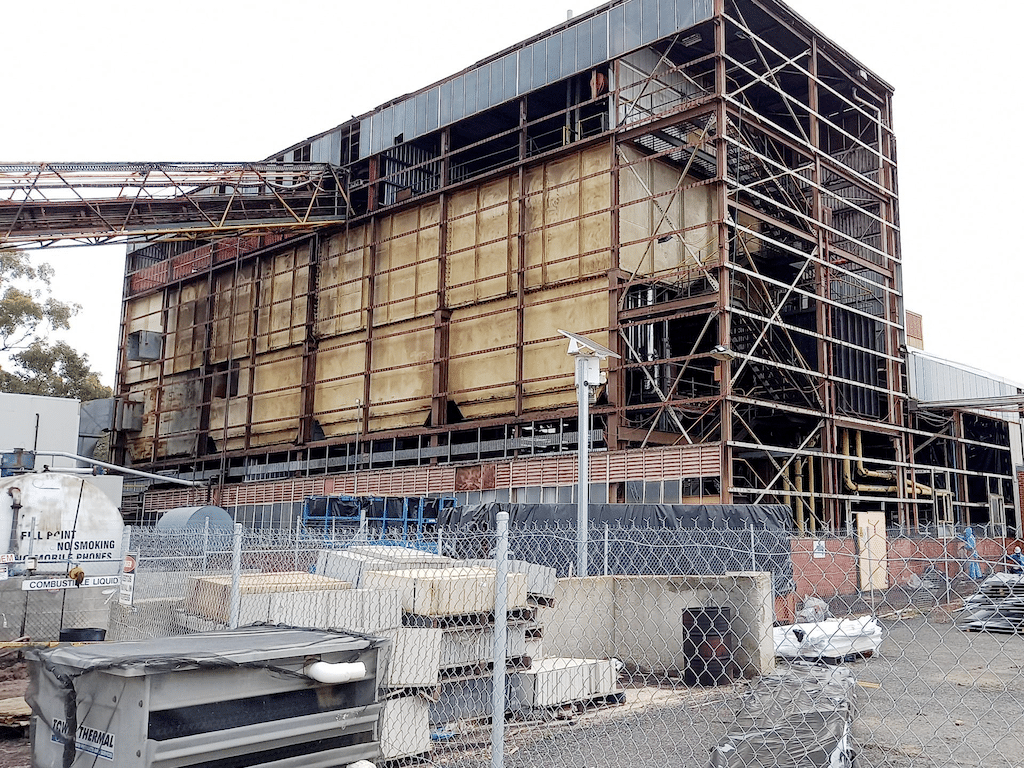

- Asbestos removal – de-cladding of the main building (photos, below)

- Clearing of legacy fixtures and fittings and large equipment inside the main building

- Civil upgrades, including concreting; levelling and extension of storage area, driveways and entry points (photo, above)

- Phase 1 (Coldry upgrade) planning permit applied for and received

Featuring a significantly more compact layout (~half the size) than the previous Coldry pilot plant design, the small-scale commercial demonstration Coldry plant will be housed inside the main building immediately adjacent to the packed bed dryer.

To clear the way and enable access to the floor space, a range of activities have been underway for several weeks, including the basic clearance of the floor space and de-cladding of the old asbestos sheeting. In line with regulations, any works which disturb legacy asbestos-containing materials requires removal by licenced hazardous material demolition specialists.

ECT Chairman Glenn Fozard commented:

“As at 19 October 2020, removal of the asbestos sheeting has been finalised and the site has been given the all-clear to proceed with the remaining internal demolition works ahead of fabrication and installation of the new plant. A big thanks to ProAs and Azcor for their asbestos work and Industrial Demolition for managing the isolated site whilst this work was completed. “Industrial Demolition will also be managing the large demolition works scheduled to start Monday 26th of October.”

Photos: the de-cladding of the asbestos sheeting from the exterior of the main building progressed over the past week, followed by a site wash-down and inspection, providing the all-clear to proceed with the remaining internal demolition works ahead of fabrication and installation of the new Coldry plant.

New Equipment

Despite covering about half of the physical footprint of the original Coldry pilot plant, the upgrade will feature approximately double the capacity. To enable this throughput, a new primary processing train will be installed, consisting of a range of higher capacity equipment including mill, mixer and extruder.

Next Steps

Following the recent completion of the de-cladding of the main building and receipt of a range of equipment, construction has commenced.

The following activities are scheduled through to the end of December 2020:

- Clearing the interior of the existing building ahead of installation

- Design (complete), fabrication & installation of support structures

- New motor & process control room (system automation & diagnostics)

- Conditioning system fabrication, installation and testing

- Construction of ‘all shelter’ for coverage of coal supply, incorporating workshop & laboratory facilities

- Electrical and process instrumentation and cabling

- Isolated commissioning and testing of new mixer, mill and extruder ahead of integration into the support structures

Chief Engineer, Mr Ashley Moore, commented “Following a great deal of work by our team over recent months we’re pleased to have commenced construction. The next 10 weeks will involve an intense schedule aimed at delivering all key components of the Coldry process by the end of December.

ECT Chairman Glenn Fozard added, “The successful completion of phase one will enable a return to Coldry production and solid fuel sales as early as May or June next year. In parallel, we’ll be advancing phase two, adding the char kiln and waste heat integration components to deliver our small-scale commercial demonstration, targeted for completion by October next year.

“Successful completion of phase two will add up to 15,000 tonnes per annum of char to our product offering, opening new revenue opportunities in pursuit of our cashflow positive objective announced in September last year.”

The Company looks forward to providing further updates as the project progresses.

Capital management update

The Company is pleased to advise it has received its 2019 financial year R&D Tax Incentive Refund.

Key points:

- $899k R&D Tax Incentive refund received

- New R&D loan facility established

The refund of $899k is in line with accruals disclosed in the Annual Financial Report at 30 June 2020, released on 31 August 2020, contributing to the funding of the Company’s Coldry Upgrade Project outlined above, which entails the small-scale commercial demonstration of its Coldry technology via integration with a high-value char application.

ECT Chairman Glenn Fozard commented, “We continue to be eligible for funding under the Australian government’s R&D Tax Incentive program, providing an important element in the funding of our current Coldry Upgrade Project, which has a budget of ~$6.5M, and is expected to deliver ~$2.8M in rebates across the 2021 and 2022 financial years.”

New R&D Loan Facility

Further, the Company is pleased to announce it has established a new R&D loan facility with local specialist lender, RnD Funding Pty Ltd.

ECT has previously utilised finance facilities that have allowed the forward factoring of anticipated R&D refunds, providing flexibility to the capital management plan by delivering cashflow when required, rather than waiting until after the tax return is lodged each year.

Chairman Glenn Fozard noted, “We recently signed the facility agreements and look forward to completing the conditions precedent ahead of the first draw down scheduled for late October.”

Established in 2015, RnD Funding describes itself as ‘a specialist lender to Australian companies undertaking research and development activities with entitlements to the R&D tax Incentive and seeking finance of $1 million+.’

Glenn Fozard continued, “Of great interest to ECT is RnD Funding’s experience and expertise is tailoring structured products to meet the needs of companies like ours, engaged in research and development activities across multiple years and different stages.”

The facility is for $1.2M which will be drawn down in several tranches, is senior secured by the Company’s R&D tax incentive, matures 31 December 2022 and incurs interest at 1% per month.

The Company looks forward to providing further updates on the progress of the R&D loan facility in due course.

Equity Lending Facility (ELF)

Finalising original ELF (issued August 2017)

The Company advises that the Equity Lending Facility (ELF) provided to borrowers in respect of options conversion in 2017 (see announcement 8 September 2017) is now expired.

Where borrowers made partial principal payments the Company has approved the release of secured shares proportionate to those principal payments.

The total number of shares released to borrowers at the end of the loan term who had made partial principal payments is 19,638,480.

As part of the limited recourse nature of the ELF, the remaining balance of 916,407,834 shares secured under the Loan Agreement have been forfeited by the borrowers in exchange for releasing them from the ELF debt. Final statements will be provided to borrowers in due course.

Establishing New ELF

A new equity lending facility (ELF) was proposed as outlined in the Prospectus dated 6 December 2019:

Section 3.2 of the Prospectus states:

ECT also offers (subject to shareholder approval) to issue up to 1,316,666,666 New Shares and 526,666,666 New Options to the Lenders on the same terms as the offer contained in this prospectus and provide funding for the subscription price of $1,580,000 by way of a loan from either ECT or ECT Finance Limited. The loan would have a 2-year term, be secured over the shares, be limited recourse and bear interest at 11.95% pa payable monthly in arrears. ECT will call a shareholders’ meeting seeking approval for the loan if a Lender wishes to take up this right. ECT is not required to issue shares or options to a Lender if ECT believes that the issue may result in a person’s voting power in ECT exceeding 20%.

The new ELF was offered to ECT’s secured debt providers, to incentivise the retirement of $1.85M worth of debt into equity via the Non-Renounceable Rights Issue (NRRI).

The actual number of securities to be issued under the new ELF, subject to shareholder approval, is 1,300,000,000 shares (ECT) and 520,000,000 options (ECTOC).

Of the 1,300,000,000 shares, 916,407,834 have been allocated from shares forfeited under the July 2017 ELF, with the balance of shares and options to be issued, subject to shareholder approval, at the forthcoming Annual General Meeting.

ECT Chairman Glenn Fozard commented, “By allocating the shares forfeited under the July 2017 ELF to the new loan holders under the new ELF, we will save over $50,000 in administration and issuance costs should shareholders vote to approve the new loan facility.”

AGM 2020

The Company is planning to hold its 2020 AGM as a Virtual AGM on Friday 27 November 2020.

A Notice of Meeting and Explanatory Memorandum is being prepared and will be released in coming weeks, confirming the timing.

Shareholders registered to receive email notifications will receive an email directing them to the Company’s website (www.ectltd.com.au) to view or download the Notice of Meeting.

Shareholders registered to receive correspondence via mail will receive a postcard directing them to the Company’s website (www.ectltd.com.au) to view or download the Notice of Meeting.

Given the virtual nature of the AGM this year, additional information will be available on the Company’s website to ensure shareholders have the opportunity to participate.

For further information, contact:

Glenn Fozard – Chairman i[email protected]