Investor News

Victorian power bill's set to rise again

As of 1 January 2020, Victorian electricity customers will be hit with price hikes.

Again.

Today's article ($) in the AFR reports that Origin and AGL will raise their prices in line with last month's ruling from Victoria's Essential Services Commission. Origin said an average residential customer would see a $122 increase in their annual bill.

Households on the safety-net default price, which replaced standing offers on July 1, will see average bills increase by about $110, while small businesses will see a $465 increase on average.

AGL will charge customers about 5 per cent on average across its discounted electricity market offers, while those on a fixed-price plan will remain unaffected.

So, how has Victoria gone from generating the most affordable electricity in Australia only a few years ago to having the most expensive wholesale electricity in 2019?

AGL chief customer officer Christine Corbett noted the price hikes were driven by a 'combination of factors', but mainly higher network charges and wholesale electricity prices.

According to the AEMC's Residential Electricity Price Trends Report for 2019, at 12.12c per kWh, the wholesale costs account for ~41% of Victorian electricity bills.

The network costs, which account for another 40%, include things like poles and wires. They also include the cost of modifying the network to compensate for the increased presence of wind and solar (but that's not overtly attributed to the cost of wind and solar generation).

The big takeaway point here—noting that 2015 was a bit of a low outlier due to a 'combination of factors'—is that the wholesale generation price has more than doubled since 2016.

But there's a paradox.

Since 2016, electricity consumption in Victoria has decreased by about 5%, while capacity has decreased by 1%.

How does a net 4% decrease in demand result in higher bills and a higher risk of blackouts?

Here's a clue.

Consider that Hazelwood power station, which closed prematurely in March 2017, had a capacity of 1,600MW and provided an average output of 1,455MW of reliable, low-cost, baseload power. That's a consistent output of 90% of its 'nameplate' capacity.

Conversely, around 2,200MW of wind and solar capacity was added, consisting of ~823MW of wind capacity, ~476MW of large-scale solar, and ~938MW of rooftop solar.

That additional wind and solar capacity operate at an average output of around 553MW.

Why is wind and solar such a weak alternative?

Simply, it comes down to five key problems:

- Intermittency

- Uncertainty

- Resource location

- Non-synchronous

- Low capacity factor

Let's quickly touch on each one.

Intermittency

There are two categories of power plants:

- Dispatchable

- Non-dispatchable

Wind and solar are known as non-dispatchable, intermittent or variable renewable energy (VRE).

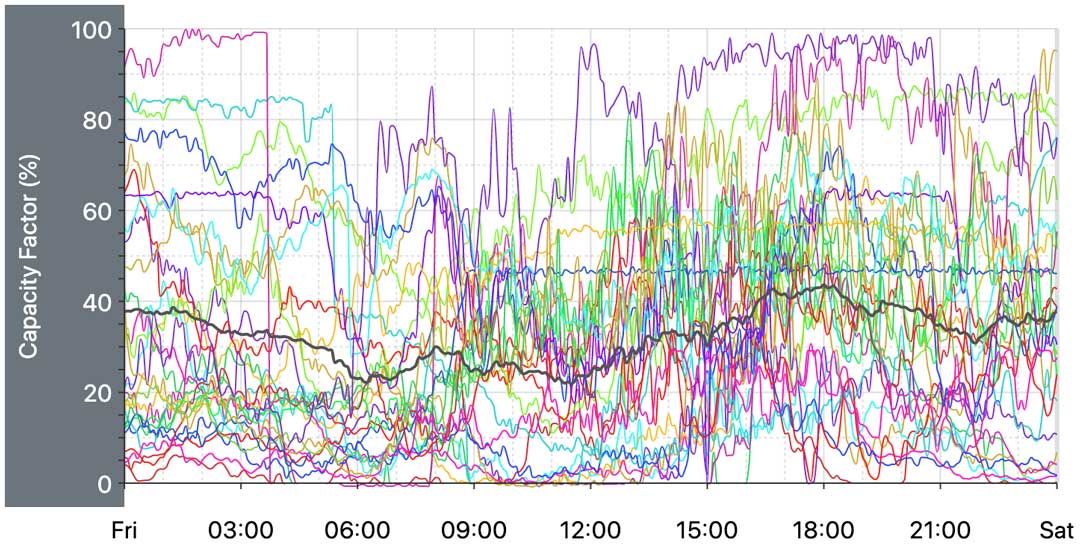

Wind can vary in output from 0% to 100% and can vary significantly in the space of a few minutes, as shown in the chart below of Victorian wind generation for Friday, December 13, 2019.

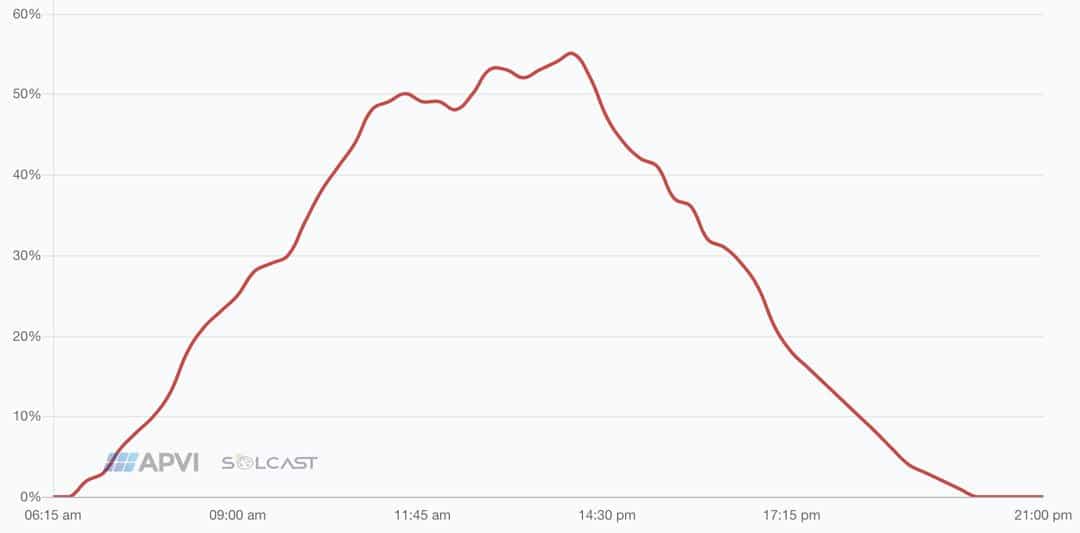

Solar varies from 0% to about 65% capacity but is less volatile. Solar also misses the morning and evening peaks, requiring expensive batteries to store electricity when we need it.

The effects of variability challenge the rules and economics that govern existing power infrastructure, requiring expensive modifications and additions.

Uncertainty

Electricity generation must always be matched to demand. Dispatchable electricity meets this requirement. Coal and nuclear act as baseload, with gas-fired power acting as the quick responder to changes in short-term demand.

Unfortunately, the output of VRE plants cannot be predicted with perfect accuracy in day-ahead and day-of forecasts, so grid operators have to keep excess reserve running just in case. This backup generation's capital and operational costs manifest as higher wholesale electricity costs.

Resource Location

Sun and wind are stronger (and thus more economical) in some places than in others — and not always in places with the necessary transmission infrastructure to get the power to where it's needed.

Connecting remote and disparate wind and solar projects to the existing network is hugely expensive in a country as large as Australia and, on average, adds about one-third to a project's cost.

Non-synchronous Generation

Electricity generation must be managed to be exactly equal to the levels being used, and properties like voltage and frequency must be minutely regulated across the whole network to ensure power generated in large power stations can be used by domestic appliances plugged into wall sockets.

The entire power network operates at 50 Hz. Just a 1% deviation begins to damage equipment and infrastructure, so it is imperative that it remains consistent.

AEMO does this instructing flexible generators (such as thermal, steam-powered turbines, hydropower or batteries) to either increase or decrease generation so electricity supply is matched exactly to demand. Generators are set up to respond automatically to these requests, correcting frequency deviations in seconds.

Dispatched power can automatically adjust to keep the country on the right frequency. It also has the advantage of adding inertia to the grid.

Inertia is an object’s natural tendency to keep doing what it is currently doing.

The spinning plant's system inertia is effectively ‘stored’ energy. This energy can be used to act as a damper on the whole system to slow down and smooth out sudden changes in system frequency across the network—much like a car’s suspension, it helps maintain stability.

VRE generators can potentially provide voltage support and frequency control to the grid, but it requires additional capital investment and expense.

Low capacity factor

This is arguably the most significant. We mentioned above that Hazelwood power station, which closed in March 2017, had a capacity of 1600MW and used to deliver around 1455MW of output.

Wind operates at around 30% capacity, while large-scale solar and rooftop solar operate at 25% and 20% capacity.

This means the 2200MW of new wind and solar capacity deployed in Victoria since 2016 only delivers an average of about 553MW of electricity.

Because of the low capacity factor of VRE, dispatchable electricity plants are needed to take up the slack, but because of the occasional instance of high output of VRE in peak hours, conventional plants sometimes don't get to run as often as needed to recover costs. As a result, when the dispatchable plants do run, they are forced to bid into the market at a higher price to maintain viability. This is an externalised cost of intermittent power generation and a direct result of government energy policy driving the increased deployment of wind and solar.

This market interference includes mandates and subsidies.

The Renewable Energy Target (RET) consists of the Large-scale Renewable Energy Target (LRET) and the Small-scale Renewable Energy Scheme (SRES).

The LRET mandates that electricity retailers purchase 33,000 gigawatt hours of additional renewable electricity generation by 2020. This creates an artificial market for the output from wind farms and large-scale solar farms. Each MWh of large-scale VRE electricity currently receives a subsidy of $39, in addition to the prevailing spot price for electricity.

For residential rooftop solar, the SRES results in around 30% of the system cost being shifted to your neighbour's electricity bill. That's right, the government isn't paying for it. Isn't it nice to know that even if you don't have solar on your roof, you're forced to pay for your neighbours (partly) through the 'environmental' component of the retail price?

In short, removing affordable, reliable brown coal-fired power and replacing it with intermittent wind and solar (which create all the above problems) will raise power prices.

But don't get us wrong. The problems associated with increased wind and solar penetration are technically solvable. We could achieve 100% wind and solar generation if the cost is no issue.

Unfortunately, the cost is an issue. From a total cost-benefit perspective, it becomes cheaper to resort to lower CO2 alternatives to VRE.

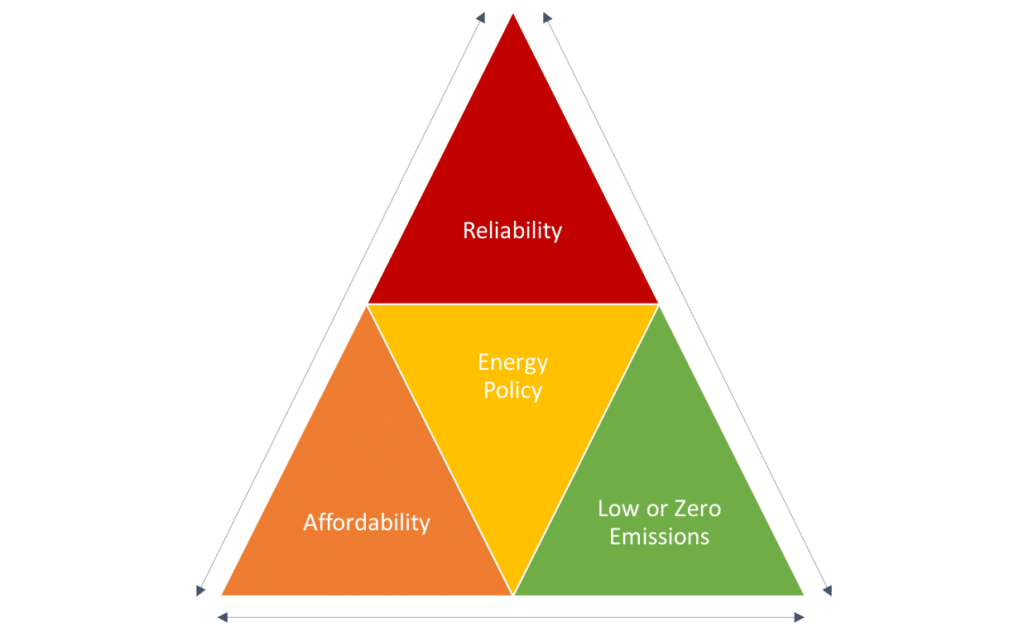

This interplay between affordability, reliability and emissions is known as the energy trilemma.

If you want a reliable, zero-emissions electricity grid, it won't be affordable.

If you want an affordable, reliable electricity grid, it won't be zero emissions.

If you want an affordable, zero-emissions electricity grid, it won't be reliable.

The exception is when you can access an abundant, dispatchable renewable energy source; Albania, which relies on 100% hydropower, is a great example. Iceland, with 70% hydro and 30% geothermal, is another.

However, the trend for countries without access to sufficient, viable hydro and geothermal resources is that increased wind and solar penetration coincide with higher electricity prices.

Here in Australia, hydropower is limited by geography and rainfall. We've had a good attempt at geothermal, but nothing commercial has emerged.

For an environmental solution to be sustainable, it must first be economically sustainable.

If we wish to balance affordability, reliability and CO2 intensity, existing brown coal power stations could be retro-fitted with our Coldry technology to pre-dry their coal, delivering a ~30% reduction in CO2.

We could also deploy a Coldry-enabled high efficiency, low emissions (HELE) power station to replace the old brown coal power stations as they retire, reducing CO2 by 42%-63%.

A sensible, affordable, transitional approach to a lower CO2 economy is possible.

Victorian's set for fresh power bill shock

13 December 2019 | AFR | Angela Macdonald-Smith

Households in Victoria are bracing for a fresh increase in their power bills next year as the country's two biggest electricity retailers, Origin Energy and AGL Energy, both advised of price hikes despite ongoing pressure from Canberra for further cuts.

Increased prices for wholesale power and higher network costs are being blamed for a 7.8 per cent increase in the Victorian default offer price on January 1, as allowed for by the state's price regulator last month.