Investor News

Germans rally against the country’s reliance on coal

Germans recently rallied against their country's reliance on coal even as poor wind conditions drove price volatility.

According to Deutsche Welle, the massive rallies were aimed at pressing the Angela Merkel administration two days before a state commission on coal consumption is to convene for the first time. The commission is tasked with finding a way to eliminate Germany’s dependence on the black mineral.

A report by the Associated Press states that about 22 per cent of Germany’s electricity comes from burning lignite or brown coal, 12 per cent from hard coal and 33 per cent is generated using renewable energy.

Besides demanding a boost in green energy sources, protesters were also expressing their rejection to a recent announcement by the environment minister, Svenja Schulze, who said the country will likely miss its goal of cutting emissions by 40 per cent from 1990 levels by 2020.

The rallies coincide with a new 'coal commission' kick-off to plan the nation's exit from coal.

The crux of the issue in the eyes of the protesters is the prioritisation of the economy over climate.

But, for an environmental policy to be sustainable, it must be economically sustainable.

Contrasting the well-intentioned green narrative that coal is dead is a resurgence in coal prices over the past 12 months.

It appears the greens divestment campaign has backfired, having the opposite effect of constraining supply, driving coal prices up and creating windfall profits for coal miners.

It makes sense. If you tighten the supply of a commodity that's experiencing increased demand, the price has to increase. This is meant to trigger investment in new capacity, returning prices to a reasonable level. However, this normal market signal isn't quite working because those who can invest in more coal capacity are afraid to do so because of calls to shut down coal, perpetuating supply constraints and propping up prices.

This begs the question: why is coal so in demand, given the rapid increase of renewables?

Simply, total energy demand is increasing, and renewables, as fast as they can be deployed, can't keep up with absolute demand growth.

Germany is arguably the world leader in renewables - wind and solar - having deployed about 40GW of solar capacity and around 50GW of wind capacity.

For context, Australia has around 6GW of solar and 4.8GW of wind.

Coal accounts for about 43% of electricity production in Germany. In Australia, black and brown coal supply around 75% of our electricity needs.

One problem driving Germany's continued reliance on brown coal has been the closure of nuclear plants. The second problem is the intermittent nature of renewables. Just last week, quiet wind conditions saw power prices double. Germany keeps its lignite-fired power plants running to back up wind.

On occasion, when ideal weather conditions prevail, and demand is moderate, renewables can account for almost all supply, if only for a brief period.

And then there's the cost.

This article highlights the record-high cost of electricity in Germany, driven by a combination of the renewable energy surcharge (20%) and the price volatility caused by intermittency.

The run-away expansion of wind turbines and solar panels has made German prices the highest in Europe since 2013, not just because of surcharges but because more volatile green power capacity also necessitates new transmission grids and higher costs to manage them.

Globally, wind and solar capacity have grown, propelled by subsidies.

Yet, China, Korea, Japan and India are all burning more coal today than in previous years, and while coal’s share of the energy market in emerging economies has slipped to around 40 per cent from close to 50 per cent a few years ago, it is 40 per cent of a much bigger market.

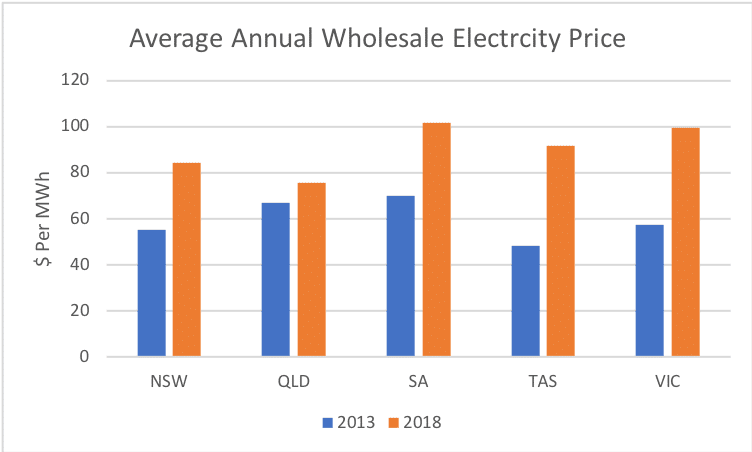

Here in Australia, our wholesale price has increased dramatically over the past five years due to the increase in renewables and the exit of several coal-fired generators.

While renewables continue to come down in cost, they remain uncommercial, requiring billions in ongoing subsidies or as yet unbudgeted storage.

Even with its world-leading effort, Germany's CO2 emissions haven't dropped in 9 years.

The greatest experiment in renewable energy deployment will fail to meet its 40% CO2 reduction target by 2020.

It will be interesting to see if Australia can avoid the same expensive failure.