Technology

Detail

Low cost, low emission hydrogen production from lignite

Catalytic Organic Hydrogen Generation

- Hydrogen from brown coal

- Low-temperature process

- Lower CO2 emissions

The briefing paper “Hydrogen for Australia’s Future” notes:

Gasification is used for solid feedstocks such as coal and waste biomass. Chemically it is a more complex process than [natural gas-based steam methane reforming] and produces a higher ratio of CO2 to hydrogen.

The production of hydrogen from lignite could follow a ‘traditional’ path, utilising ‘standard’ gasification and gas refining technology, or it could seek to optimise its energy input and yield and minimise its CO2 footprint via innovation.

ECT is developing an alternative to the conventional gasification-steam methane reforming method of hydrogen production from lignite, called Catalytic Organic Hydrogen generation, featuring:

- Enhanced hydrogen yield

- Lower operating temperature (lower operating cost, higher energy efficiencies)

- Lower CO2 emissions – the majority (60% – 70%) of the carbon is deposited as a solid rather than being emitted, resulting in lower CCS cost

The successful outcome of R&D initiatives can be enhanced through collaborative programs, enabling the identification and joint development of innovative approaches to reducing cost and emissions

Features and Benefits

- Low-temperature, more efficient, lower-cost capex and opex

- Lower CO2 emissions than the coal gasification steam reforming process

- >50% H2 concentration in the gas stream

- Low-cost feedstock – lignite

- Replace natural gas

- Scalable

- Affordable, abundant, reusable catalyst

- Majority of the carbon captured in solid form

The Process

How it works

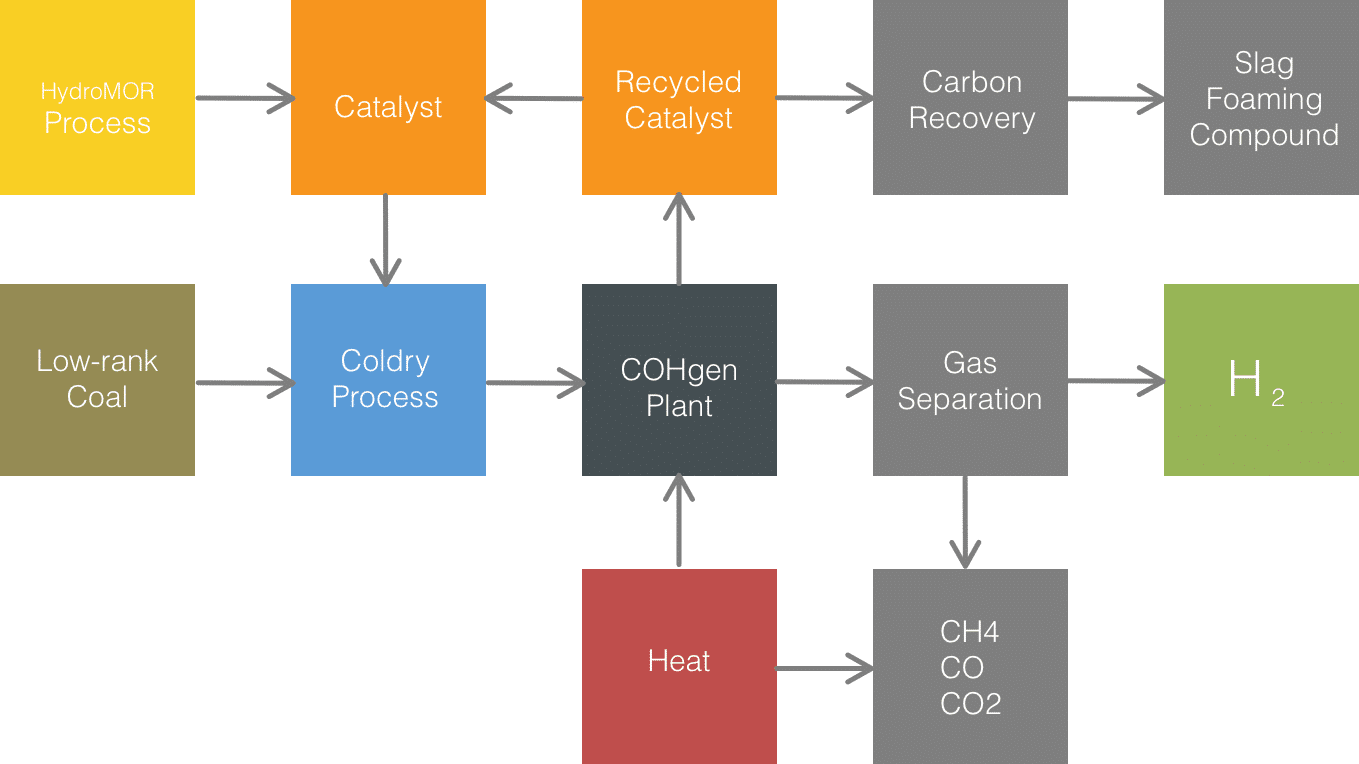

The COHgen process utilises a unique low-cost catalyst (courtesy of our HydroMOR process) to facilitate the low temperature catalytic thermal decomposition of the hydrocarbons generated from lignite.

We’re currently proceeding through fundamental lab-scale research to generate the data necessary to define the parameters for our patent application.

As such, we can’t disclose the underlying details, just yet.

Suffice to say we’ve achieved higher H2 yield at a lower temperature than standard lignite gasification.

The other significant observation is the amount of carbon deposited within the process. Typical gasification is higher temperature and features high CO2 emissions.

COHgen is different.

The majority of the carbon remains in solid form, helping to overcome the biggest objection to the use of lignite for hydrogen production: CO2 emissions.

Minimising CO2 emissions also has the benefit of reducing the subsequent cost of carbon capture and storage (CCS).

We’re also testing various methods for recovering the carbon as a valuable output. If successful, this could enhance the economics of the process, making it even more economically attractive compared to conventional methods.

The product

The output from the COHgen plant is a hydrogen-rich gas.

Other components include carbon monoxide (CO), methane (CH4) and carbon dioxide (CO2).

Standard gas separation processes can be employed to isolate the H2 and, where appropriate concentrate the remaining CO2 for capture, storage or utilisation.

The CO and CH4 are a valuable gas fuel which can be utilised within the COHgen process or potentially sold to gas customers.

Applications

Hydrogen applications across domestic and export markets include:

- Transport fuel via hydrogen fuel cell vehicles (HFCV’s)

- Supplementing or substituting natural gas for heating

- Energy storage – firming intermittent wind and solar power

The Australian Governments vision for developing Australia’s hydrogen industry is clear:

“Our vision is a future in which hydrogen provides economic benefits to Australia through export revenue and new industries and jobs, supports the transition to low emissions energy across electricity, heating, transport and industry, improves energy system resilience and increases consumer choice.”

‘Hydrogen for Australia’s Future, Commonwealth of Australia, 2018’.

Getting there

The CSIRO’s National Hydrogen Roadmap provides a blueprint for the development of a hydrogen industry in Australia, showing that while government assistance is needed to kick-start the industry, it can become economically sustainable thereafter.

- It first assesses the target price of hydrogen needed for it to be competitive with other energy carriers and feedstocks.

- Second, the assessment considers the current state of the industry, namely the cost and maturity of the underpinning technologies and infrastructure.

- It then identifies the material cost drivers and consequently, the key priorities and areas for investment needed to make hydrogen competitive in each of the identified markets.

Hydrogen becomes competitive with petrol at $8kg in the domestic Australian market but needs to achieve a landed cost of $2kg in Japan to compete with LNG.

Given the current hydrogen production cost of $2.60 to $3.10 per kg (for coal or natural gas based hydrogen production) and a cost-competitive price point of $8kg, hydrogen would be a viable petrol substitute right now, if supply, distribution and storage were available.

To this end, the roadmap highlights the biggest barriers as cost of supply, the lack of supporting infrastructure and need for market activation.

The ‘real’ hydrogen challenge

CCS Hydrogen vs Renewable Hydrogen

The obstacle to realising hydrogen’s clean energy potential is that on Earth it is virtually non-existent in its free form. Energy must be used to liberate it from the material forms in which it exists, such as water, biomass, minerals and fossil fuels.

What makes hydrogen particularly attractive here in Australia is the wide variety of our abundant fossil fuel and renewable energy sources.

Two pathways for clean hydrogen production are prescribed by the hydrogen roadmap:

- CCS hydrogen – made from fossil fuels like coal or natural gas, with carbon capture and storage (CCS).

- Renewable hydrogen – made from water electrolysis using electricity generated from renewable sources.

The hydrogen is compressed and transported to where it is needed. The energy to produce the hydrogen is subsequently released at the point of use. As such, hydrogen is technically an energy carrier rather than an energy source.

COHgen falls within the CCS hydrogen category and is anticipated to be cheaper at scale than renewable hydrogen or traditional gasification-based CCS hydrogen routes.

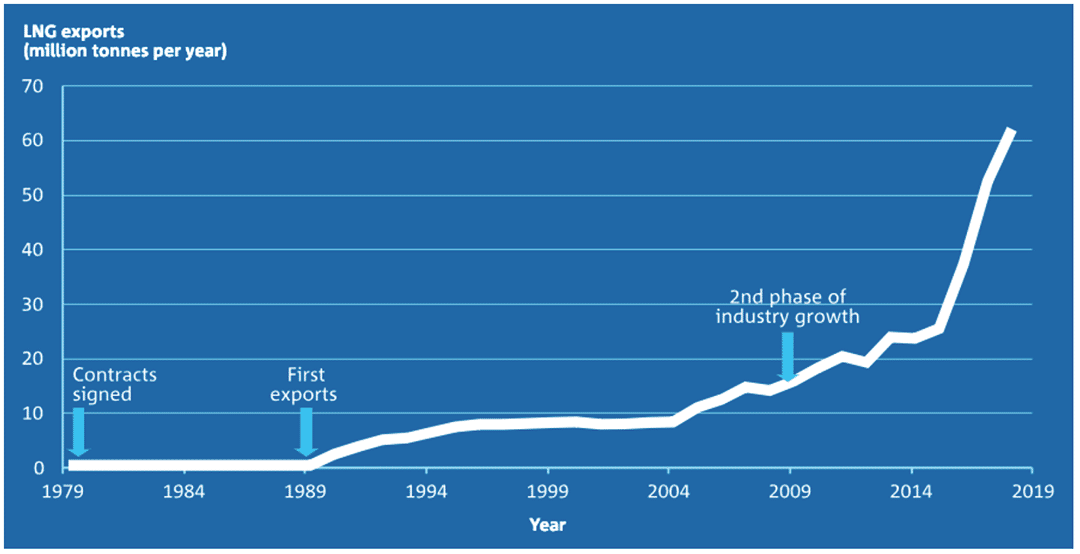

The various reports prepared to drive and inform the discussion on hydrogen industry development highlight the challenge of scaling technology and supporting storage and distribution infrastructure. The emergence and development of Australia’s LNG industry is used as a case study for overcoming scale-up challenges.

And while the parallels are clear, the biggest challenge in scaling the hydrogen industry is actually scaling the primary energy source.

Few laypeople understand that hydrogen is not a fuel in its own right like coal, gas or oil, but rather an energy carrier, taking energy from a primary source and storing a portion of that for later ‘use’ via combustion or electricity (fuel cell).

The issue papers outline the potential market for hydrogen, which is conservatively expected to grow from 8 to 18 Exajoules by 2050. If realised, this is equivalent to 3 times Australia’s entire 2016-17 energy consumption.

Estimates noted within the issue papers suggest Australia could ‘easily’ produce 100 million tonnes of oil equivalent (mtoe) of hydrogen. Restated, this is 4.18 exajoules or 34.8 million tonnes of hydrogen, equivalent to two-thirds of Australia’s current total energy consumption (not just electricity), and just over half of current LNG exports highlighted in the above chart.

For reference, current global hydrogen production is ~70 million tonnes annually, with three quarters generated via the steam reformation of natural gas and the remainder via coal gasification (23%) and electricity-based electrolysis (2%).

Why are these figures important?

They quantify and provide context for the underlying scale challenge – production or sourcing of the primary energy needed to make the hydrogen. In the case of CCS hydrogen, the energy comes mainly from the coal or gas itself. In the case of renewable hydrogen, new wind and solar generation capacity is required.

Scale-up of hydrogen production, storage, distribution and transport infrastructure is certainly a significant challenge given the volume of hydrogen required, however, the larger challenge is increasing our total energy supply to meet the primary energy needs to deliver the potential of 100 mtoe.

Therefore, it is important to couch the hydrogen scale challenge in terms of the features, benefits, pros, cons and total system cost of a particular primary energy source, or portfolio of sources, with benchmarking for each to ensure the principle of technology-neutrality is not ‘gamed’ through externalisation of hidden costs by renewable hydrogen proponents.

Further, it is important to understand the above in the context of the application, target market and how it compares with alternative energy sources in those markets.

For example, the issue papers estimate hydrogen to be competitive with petrol at $8kg while needing to achieve a $2kg landed cost to compete with LNG, clearly indicating the transport application to be the ideal early target. However, it is unclear from these estimates whether provision is made within the hydrogen price modelling to cater for the transition in fuel excise arrangements as petrol is phased out.

Understanding the primary-energy scale challenge

Three distinct opportunities for hydrogen have been highlighted through the consultation process:

- Export

- Domestic

- Grid-firming (backing up of intermittent wind and solar with dispatchable generation or storage)

Two production routes are proposed:

- Renewable hydrogen (wind & solar plus electrolysis)

- CCS hydrogen (fossil-fuels plus carbon capture and storage)

These routes present profoundly different primary energy scale challenges.

Fossil fuels feature higher energy density presenting an opportunity for economies of scale.

Conversely, renewable energy has an extremely low energy density, requiring additional electricity or gas network connection costs.

To understand the scope of the challenge, useful examples may be provided via indicative scenarios.

Export Scenario

Let’s consider:

- Electrolysis presently requires 50kWh per kg of hydrogen

- It would take 2GW of wind capacity and 3GW of solar capacity to provide 100,000 tonnes of hydrogen annually via electrolysis

- The EIA estimates Australia could ‘easily’ produce 4.18 exajoules of hydrogen per year given our renewable resources (wind and sun)

The first target of 100,000 tonnes of hydrogen is modest, requiring 2GW of wind or 3GW of solar respectively. This is not a stretch.

However, scaling to a meaningful number such as 100 mtoe equates to 34.8 million tonnes of hydrogen at 120MJ per kg.

To achieve an outcome of 34.8 million tonnes of hydrogen, Australia would require dedicated additional wind or solar capacity of ~660GW or ~795GW, respectively. For context, Australia has ~6GW of wind meeting 7.1% of electricity demand and ~12GW of solar PV providing 5.2% of our electricity needs (end of 2018).

In terms of land area requirements, as a rule of thumb, wind and solar PV (Photovoltaic Panels) require 20 and 2 hectares per MW of capacity, respectively. Hence, 34.8 million tonnes of hydrogen production, using electrolysis, and powered by wind or solar would require an additional 13.4 million or 1.6 million hectares of land area respectively – the equivalent of 6.7 million Melbourne Cricket Ground’s for wind and 805,000 for solar.

For further context, global wind and solar capacity only surpassed 600GW and 500GW, respectively in 2018.

Wind and solar resources are abundant and ‘free’, but the equipment and networks required to harness that ‘free’ energy requires massive investment. Wind and solar are diffuse and intermittent, requiring vast areas of land, additional network costs for transmission and additional firming costs, which are presently externalised. In short, the use of intermittent primary electricity supply compounds the hydrogen industry scale challenge.

CSIRO’s National Hydrogen Roadmap highlights the three options for sourcing electricity for the electrolyser:

- Grid-connected: Electrolysers draw electricity directly from the network. Despite the emissions intensity of the network, low emissions electricity can still be utilised by securing power purchase agreements (PPAs) with utilities for low carbon electricity.

- Dedicated renewables: Behind the meter (or off grid) electrolyser connection to dedicated renewable energy assets such as solar PV and wind. Electrolysers co-located with both solar PV and wind will allow for a higher capacity factor.

- Curtailed renewable energy: Energy is sourced directly from the grid but only when there is surplus renewable energy available (or sourced directly from renewables when the economics do not favour export to the grid).

It may be helpful to define ‘capacity factor’ in the context of the above points and following table. Capacity factor is the percentage of actual electrical output out of the total possible electrical output of a generation asset.

Renewable energy sources such as wind, solar and hydro do not generate energy all the time.

The ability for wind and solar plants to reach their full generation capacity is totally dependent upon the intermittent availability and intensity of wind and solar energy, which is determined by weather conditions and the time of day. Put simply, they depend on how much the wind blows and the sun shines.

Generation can range from zero to one hundred percent. In Australia wind power achieves an average 30% of its installed capacity and solar PV achieves 25%.

In the case of hydro, capacity factor depends on when it is switched on to meet spikes in demand. Hydro’s ability to be rapidly activated in this way, is essential to firming renewable energy but limited by geography and rainfall.

Dispatchable generation such as fossil fuel and nuclear can produce electricity on demand. Variable or intermittent generation is at the whim of the elements.

Coal provides around 83% of Australia’s electricity, operating at 75% of capacity (brown coal, ~90%; black coal, 75%; gas, 63%).

Scaling the deployment of the actual electrolysis units is relatively simple. In comparison, the associated techno-economic scale issues for the renewable energy required to run them are significant.

The cost of CCS hydrogen (that is, hydrogen produced from fossil-fuels plus carbon capture and storage) is estimated in the same report to be in the order of $2.14-$2.74kg.

In addition, the negative environmental impacts on wildlife and degraded natural scenic aesthetics presents a challenge for expansion of renewable energy infrastructure, with former Greens leader Bob Brown recently opposing the application for what would be Australia’s single largest wind farm (up to 1000MW capacity) on Robbins Island, off the north coast of Tasmania, citing the impact on coastal scenery and birdlife.

Based on the currently available data, export volumes are best achieved, technically and economically, by CCS hydrogen. A healthy export market for CCS hydrogen will achieve economies of scale and reductions in cost that can benefit domestic markets and support the gradual, economically responsible entry of renewable hydrogen.

Domestic Applications

The hydrogen strategy working group noted the potential for increased market coupling. In other words, hydrogen could supply the electricity generation market, the gas market or the transport market in addition to other industrial uses.

This presents an opportunity to increase energy diversity, which is good for consumers, but a threat to incumbent energy providers. Regulations should seek to prevent incumbent energy providers from using market position to prevent or delay hydrogen-based market coupling.

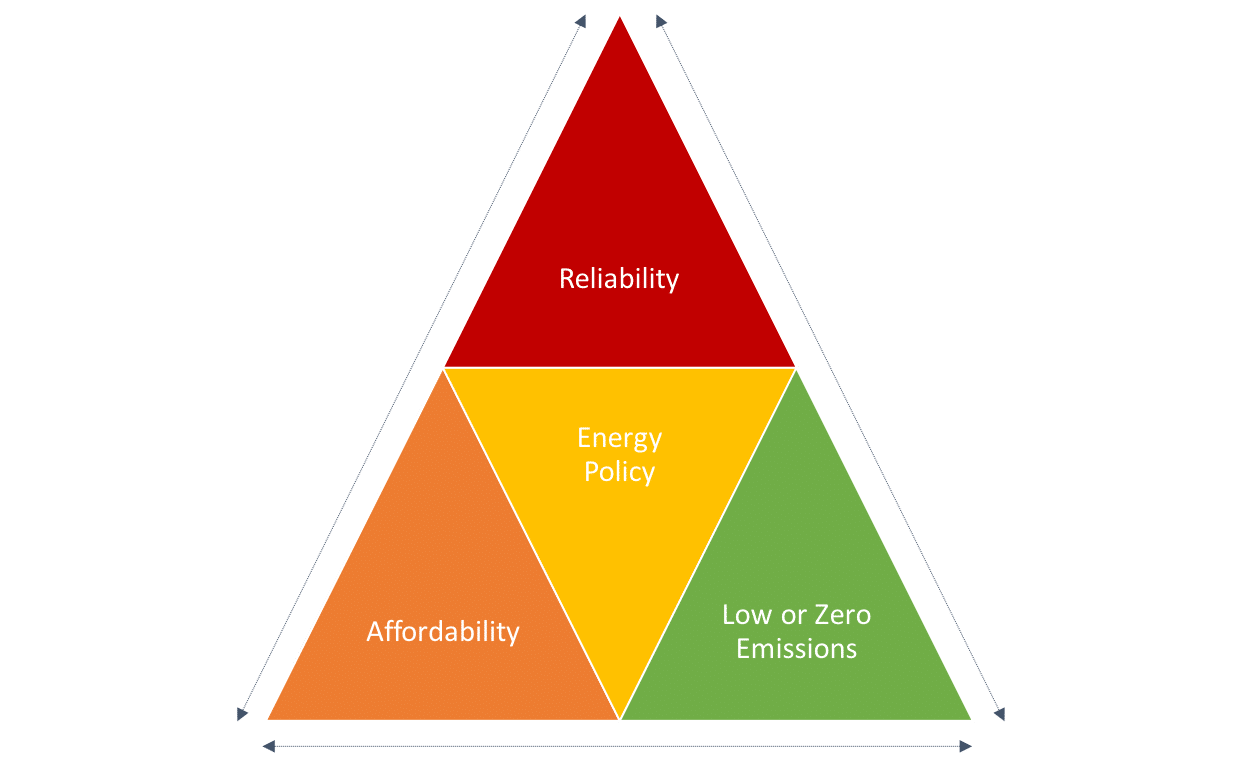

Further, the National Electricity Market (NEM) continues to face an energy trilemma: the challenge of achieving secure and reliable energy supply while reducing carbon emissions and ensuring affordability for consumers.

This trilemma is reminiscent of the trilemma popularised by the legendary oil well firefighter, Red Adair: Good, cheap, fast. Pick any two.

In the case of energy policy: affordable, reliable, low emissions. Pick any two.

The Independent Review into the Future Security of the National Electricity Market by Chief Scientist Dr Alan Finkel (Finkel Review) convened a committee of energy market experts, which made 50 recommendations aimed at addressing the energy trilemma.

Hydrogen-based solutions can clearly play a role in the domestic energy mix, across multiple industries. However, further analysis is required to understand the point at which hydrogen becomes competitive in various applications and markets so that collective resources are focused predominantly on efforts that can achieve commercial scale, allowing subsequent advances in technology and cost reduction to open the door to other applications that require lower-cost hydrogen to be competitive.

Grid-firming

There are two distinct considerations when discussing grid ‘firming’ (back up of intermittent wind and solar):

- Lack of supply during times of demand

- Lack of demand during times of higher supply

There is a third consideration – frequency control services – related to grid stability.

This is an increasingly important topic given the AEMO report an additional 2.5GW of wind capacity is committed, and a further 16.6GW is proposed.

The Finkel Review recommended a Generator Reliability Obligation which provides that if a “new” variable renewable energy (VRE) generator wishes to connect in a region that is close to the limit of minimum dispatchable capacity, that it must provide an amount of new dispatchable generation capacity from within the same region.

Under the recommendations, additional dispatchable generation capacity cannot come from existing generation capacity. It must be new capacity.

There are times when the wind is blowing, or the sun is shining, and no one needs the electricity. This electricity generation is generally curtailed and therefore lost. At present, this may be as high as 10% of the time.

Directing this ‘spare’ renewable energy to storage, such as batteries, pumped hydro or hydrogen electrolysers, would help firm the intermittency of wind and solar, creating dispatchable renewable electricity. This is covered in detail in the CSIRO’s National Hydrogen Roadmap.

Renewable hydrogen may have a place as a solution for grid-firming in the context of a broader approach utilising a combination of batteries, pumped hydro and hydrogen. This is outlined in ARENA’s 2018 report, ‘Comparison of Dispatchable Renewable Energy Options’ and should be considered a direct cost of wind and solar, per the Finkel Review recommendation.

Further analysis is required to confirm the techno-economic feasibility thresholds for renewable hydrogen firming as a result of increased wind and solar penetration.

Delivering innovative, scalable hydrogen production

- Core to achieving hydrogen production at scale is higher volume at competitive cost in target applications without mandates or subsidies beyond those needed to overcome initial structural barriers.

- Key to understanding and subsequently meeting the scale challenge is being overt with the scale challenge of providing the primary energy required to produce the hydrogen, regardless of production route.

- The pros and cons of the scale challenge need to be articulated in terms that include the primary power source, its impact on all environmental measures, in addition to the cost, scale and impact of supporting storage, distribution & transport systems required to get the hydrogen to market.

- The ‘network overhead’ needs to be articulated so the additional connection cost of diffuse, distributed green hydrogen can be assessed against geographically compact CCS hydrogen alternatives.

- CCS hydrogen production has the benefit of lower network overhead cost, as it doesn’t require the additional power lines or hydrogen gas pipe infrastructure of dispersed or remotely located wind or solar.

- CCS hydrogen production has a CO2 footprint. Technology R&D to advance CCS hydrogen production methods aimed at reducing costs and minimising or eliminating CO2 emissions, should be supported.

- The energy trilemma is a feature of CO2-constrained energy markets, describing the relationship between affordability, reliability and emissions. CCS hydrogen production provides an affordable, reliable (dispatchable) route compared to renewable hydrogen, which can provide low or zero-emission hydrogen, but with lower reliability and at a higher cost.

COHgen is positioned to support the further improvement of the already superior techno-economic case for CCS hydrogen scale up via innovative approaches to lignite drying and hydrogen production.