Investor News

Alinta Energy makes billion dollar bid for Liddell power station

Coal is dead.

So why is Alinta making a billion-dollar bid for the 45-year-old 2,000MW Liddell coal-fired power station in NSW?

According to the below article from The Australian, Alinta is offering $1.2 billion for Liddell.

The current owner, AGL, has announced its plans to close Liddell in 2022. It intends to replace it with a proposed mix of gas-fired power, renewables, battery storage and demand response, coupled with an efficiency upgrade at its Bayswater Power Station and conversion of generators at Liddell into synchronous condensers.

Energy policy in Australia over the past decade has been geared to subsidise Wind and Solar, with the aim of helping them to become commercial.

Despite around $30 billion in subsidies, neither Wind nor Solar are currently commercial. If they were commercial, the subsidies would no longer be required.

The unintended consequence of this energy policy?

An unexpectedly large jump in electricity prices and reduced reliability.

You've heard about the energy trilemma by now: Affordable, reliable, low-emissions... pick any two.

The story being pushed by renewables advocates is that coal is dead. Companies taking full advantage of subsidies for Wind and Solar have also reaped windfall profits from peak wholesale prices.

Threatening the story that coal is dead is our 5th largest integrated energy provider, Alinta.

Alinta purchased the Loy Yang B brown coal-fired power station from AGL last year. It allowed Alinta to lower its average wholesale cost, arguably delivering the lowest retail offers in the east coast market. Now it wants to add Liddell to its portfolio.

If coal were dead and renewables were cheaper than new coal plants, then Alinta wouldn't be offering to purchase Liddell and renewables advocates wouldn't be demanding the retention of subsidies to prop up investment 'certainty'.

Nevertheless, the political headwinds for coal remain strong. But coal remains the most affordable of the dispatchable technologies, thanks to the high price of gas and the intermittent nature of Wind and Solar.

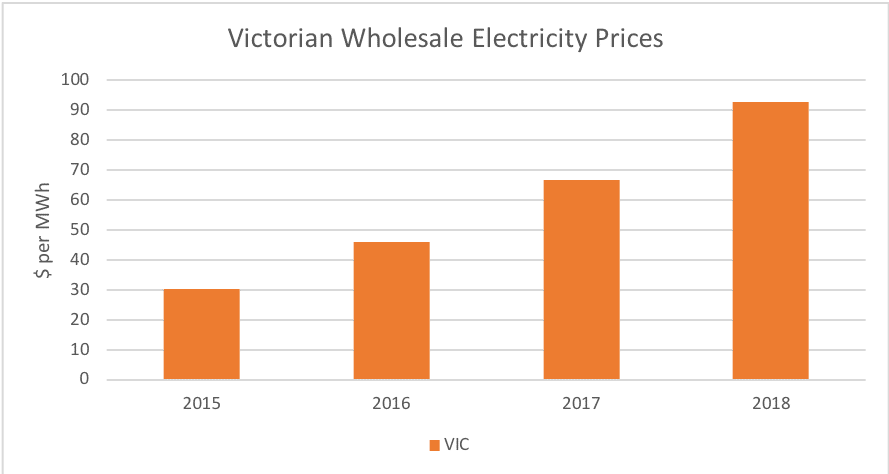

In our home market of Victoria, the policy settings remain anti-coal when it comes to new power generation, despite a 300% increase in wholesale power costs since 2015 and the change from being a net exporter to a net importer of electricity since the sudden closure of Hazelwood power station last year.

But there is an established market where coal still has a place in Victoria: industrial heat applications.

You see, Wind and Solar aren't suitable for providing process heat to industrial applications such as timber drying, dairy, abattoirs, hydro and aeroponics.

Back in 2014, the Morwell briquette plant closed down, forcing those consumers to switch to alternative fuel sources.

Most switched to gas, some to biomass (e.g. woodchips).

The rapid increase in gas prices in the past year or so has seen some businesses resort to importing coal from NSW or QLD at a cost of more than $400 a tonne.

It also meant we started to receive enquiries about our Coldry product, leading to a series of test trials with several end users. More on those prospects as we progress.

Importantly, Coldry is the only zero-emission coal drying process on the market. Any other coal drying process that seeks to enter the market and use more than 27,000 tonnes of coal per annum must not emit more than 0.3t of CO2 per tonne of coal.

Coal will eventually be replaced, but the story that it's dead is premature.

Read more...

Alinta Energy makes billion-dollar bid for Liddell power station

Energy retailer Alinta has made a $1.2 billion bid for the Liddell power station in NSW in a move that will ramp up public pressure on AGL to either sell or reverse its controversial decision to shut down the coal-fired power station by 2022.

Source ($): Alinta Energy makes billion dollar bid for Liddell power station