Investor News

Hydrogen the next LNG?

If the latest report from Australia's Chief Scientist Alan Finkel is anything to go by, Hydrogen could be the next LNG, and lignite (brown coal) will play a significant part.

The Australian's Simon Benson reports (link $):

Chief Scientist Alan Finkel will deliver a series of recommendations to federal and state governments today on developing a hydrogen energy industry, telling Council of Australian Governments energy ministers that Australia is now in a global race for hydrogen production as a future energy source that could rival LNG.

In what could also future-proof the coal industry, Dr Finkel plans to tell the energy ministers that brown coal with carbon capture is still the cheapest way to produce hydrogen and could underpin a major new export market for Australia.

This view builds on a 2008 report by the Australian Academy of Sciences (ACS): Towards Development of an Australian Scientific Roadmap for the Hydrogen Economy.

The report highlights the drivers shaping the hydrogen market:

- existing fossil fuel energy supplies and costs, and future requirements for industry and communities;

- access to alternative natural resources such as hydroelectric and geothermal;

- targets to reduce vehicle and greenhouse emissions;

- natural advantages for alternative energy generation from wind and solar;

- future vehicle zero-emission targets utilising hydrogen as an energy carrier and source; and

- new technology industry development opportunities.

In the context of the above, let's take a quick look at:

- Production

- Storage & distribution

- Applications

Hydrogen Production

Currently, the most common industrial-scale method for hydrogen production is the 'steam reforming' of natural gas. That's great in places like the USA or the Middle East with plenty of cheap gas. But not for Australia with high gas prices.

And as our Chief Scientist points out, lignite with carbon capture and storage (CCS) is the cheapest hydrogen pathway, giving Victoria a competitive advantage in an industry that could become the next LNG.

This approach involves gasification of the lignite to produce syngas, followed by a steam reforming process.

A $500 million pilot project led by Kawasaki Heavy Industries and supported by a $100 million grant from the Federal and Victorian State governments plans to test the production and transport of hydrogen from lignite.

Having abundant lignite, wind and solar resources, there's no doubt Australia is spoilt for choice when it comes to being positioned to play a leading role in the global hydrogen economy. This gives us the opportunity to pursue multiple production avenues.

Japan is notoriously resource-constrained.

At a smaller scale, splitting water to produce hydrogen is often used. This process is called electrolysis. It's more expensive than steam reformation, however, if wind or solar are used to generate the electricity, there are no CO2 emissions, attracting the 'green' hydrogen label.

Wind is highly variable and often blows when we least need it. Storing that unused wind energy as hydrogen for later use or export is sensible.

Places such as South Australia have announced plans to make hydrogen using 'spare' wind or solar power.

The problem is scale.

If we want to be a world player in the production and export of hydrogen to places like Japan, we need to be able to produce large amounts on an affordable, reliable basis. And while 'spare' renewable capacity allows us to store 'unused' wind and solar energy via hydrogen in a cost-effective manner, it can't support commercial hydrogen production volumes without dedicated, expensive, new wind and solar capacity.

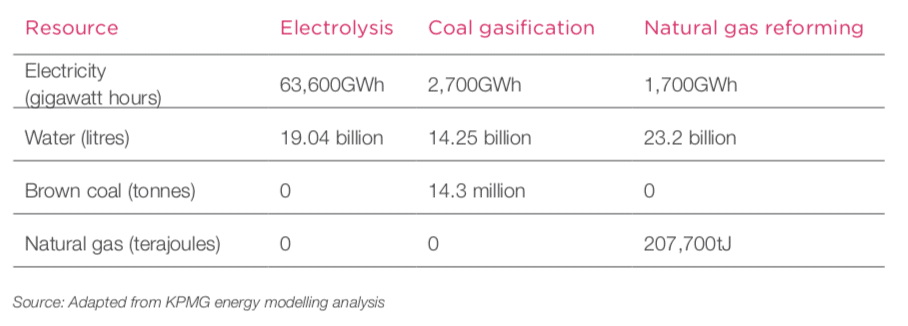

A recent report by Infrastructure Victoria on the potential uptake of automated electric vehicles highlights the issue of scale for hydrogen production. Using KPMG modelling, the report shows the challenge (and this is just for Victoria, let alone exports to Japan):

KPMG estimates the cost to deliver this new wind capacity for the 'electrolysis' scenario to be $14.5 billion in today's dollars.

In addition to the electricity requirement being almost 24 times greater than coal gasification, the water requirement is 33% higher as well.

This is in addition to the electricity required to supply homes and business.

So, there's a battle between 'green' and 'brown' hydrogen.

Storage and Distribution

Hydrogen is the most abundant element in the universe. It's also the lightest. Containment requires a robust approach to engineering to avoid leakage and other issues.

Hydrogen can't be piped through regular natural gas pipelines. It makes that particular grade of steel pipe brittle over time.

Similarly, storage tanks need to be made of specific grades of steel to minimise hydrogen embrittlement and seals need to be engineered to a higher standard to minimise leakage.

Hydrogen is also highly explosive. Hydrogen tanks in HFCVs need to be highly engineered to achieve expected safety standards.

The CSIRO has made promising headway in their attempt to store and transport hydrogen as ammonia (NH3).

In terms of retail distribution, we added LPG tanks to petrol stations in the past. Adding distributed hydrogen storage is just as doable.

Applications

But there's another layer to the unfolding dynamics.

The primary driver for the development of a global hydrogen industry will be the adoption of hydrogen fuel cell vehicles (HFCV's). This depends on their cost, and the cost and availability of hydrogen, which in turn depends on the cost and availability of production, storage and distribution infrastructure.

This battle is being waged against the current electric vehicle (EV) front-runner; the battery electric vehicle (BEV).

According to 'Information Trends', at the end of 2017, there were 6,500 HFCVs globally. Half in California. Current estimates suggest that may reach 10,000 by 2022.

BEV's on the road at the end of 2017 totalled around 1.9 million. A significant head start.

It makes sense. You can buy a Tesla right now, plug it in overnight to charge and drive to work each day.

So why are HFCVs even in contention?

In favour of HFCVs is the promise of quick fill and go (subject to hydrogen availability). BEV's need hours of charging to 'fill'.

In favour of BEVs is the ability to charge at home or work. BEV's cost and efficiency are currently better than HFCV's. Directly charging the battery of a BEV using wind or solar is 69% efficient compared to 23% when using the same wind or solar to produce hydrogen for HFCVs. The main issue with BEVs is range anxiety and charging time. In a country like Australia with vast distances between major cities, travel becomes an issue for BEV owners.

But, just when you thought BEVs were the way to go, we realise that raw materials essential to today's modern batteries are at serious risk of supply constraints. This is the equivalent of an oil shortage for internal combustion vehicles.

BEVs require very large batteries that include 'exotic' materials such as lithium and cobalt. Competing against BEVs for these raw materials are stationary applications;

- Utility-scale batteries to provide backup to intermittent wind and solar

- Residential and commercial battery systems to store excess solar during the day, providing power overnight

This combined demand presents a significant challenge to battery manufacturing supply chains.

China and South America have the most lithium reserves. Australia has the 4th largest reserves.

In this context, Japan's relationship with Australia and decision to develop hydrogen decouples it from commercial and geopolitical risks associated with constrained lithium supply as a leading vehicle manufacturer.

Further, we see Japan's decision to pursue 'brown' hydrogen as reflective of the cost and scale limitations of hydrogen production associated with wind and solar.

We have no doubt that 'green' hydrogen from 'spare' wind and solar capacity will have a place, despite its high cost. But in commercial terms, Victorian lignite is capable of delivering the lowest cost hydrogen, reliably.

ECT is currently in the early stages of researching its own hydrogen production technology: COHgen, short for Catalytic Organic Hydrogen generation.

Laboratory testing confirms significantly higher hydrogen yield from lignite compared to standard gasification.

There is still a significant amount of work to develop the COHgen process. We're focused on identifying the fundamental chemical and thermal parameters ahead of a program that will seek to scale up the process. If successful, we may just have a cheaper, lower (or even zero) CO2 method for hydrogen production from lignite.