Investor News

Energy Australia seeks brown coal licence extension

Energy Australia, the owners of Yallourn power station, which provides 25% of Victoria's electricity, have applied for an extension to their mining license.

The article ($) below by Herald Sun reporter Tom Minear quotes Energy Australia's Mark Collette...

“We are currently assessing the potential impact on our business from the introduction of a Victorian Renewable Energy Target and the possibility of a National Energy Guarantee,” Mr Collette said. “Right now, our plan is to continue to invest in Yallourn and our people for so long as the plant is needed, so our customers continue to receive reliable, affordable electricity supply.”

Why is this important?

Firstly, Yallorn's mining license expires in 2026, while the plant is scheduled to operate until 2032.

Granting of the application would simply ensure the coal supply matches the asset life.

Secondly, as ECT shareholders will be aware, we are working with Energy Australia as the preferred site for our proposed large-scale Coldry demonstration plant.

Key to proceeding with the project here in Victoria is access to coal and a waste heat source. Yallourn power station and mine can provide both.

If we wish to expand capacity beyond the initial 170,000 tonnes per annum output of the demonstration plant, it helps to have ongoing access to coal and a waste heat source. Ideally, we'd like to see the development of a Coldry-enabled HELE power station to replace Yallorn's current plant, along with a Coldry-led 'gateway' project producing upgraded brown coal products such as hydrogen, and chars, PCI coal, fertiliser and hydrocarbon liquids and gases.

The backdrop to this story is the sudden closure of the Hazelwood power station in March last year, removing 1600 megawatts of capacity from the grid, causing a jump in prices and a fall in the reliability of electricity supply.

Energy Australia is concerned Victoria's renewable energy target of 40% by 2025 will further distort the market, prompting a decision to close down earlier than 2032.

Let's take a slight detour to briefly outline the electricity market production profile at present.

Coal power is designed to run continuously at high capacity (80% plus), providing reliable, affordable baseload power. In Victoria, thanks to cheap, abundant brown coal, the cost per megawatt-hour is around $35.

Coal isn't good at turning on and off or ramping up and down to meet sudden changes in supply from other generators, so gas-fired power and hydropower are used to fill the gaps caused by intermittent wind power generation.

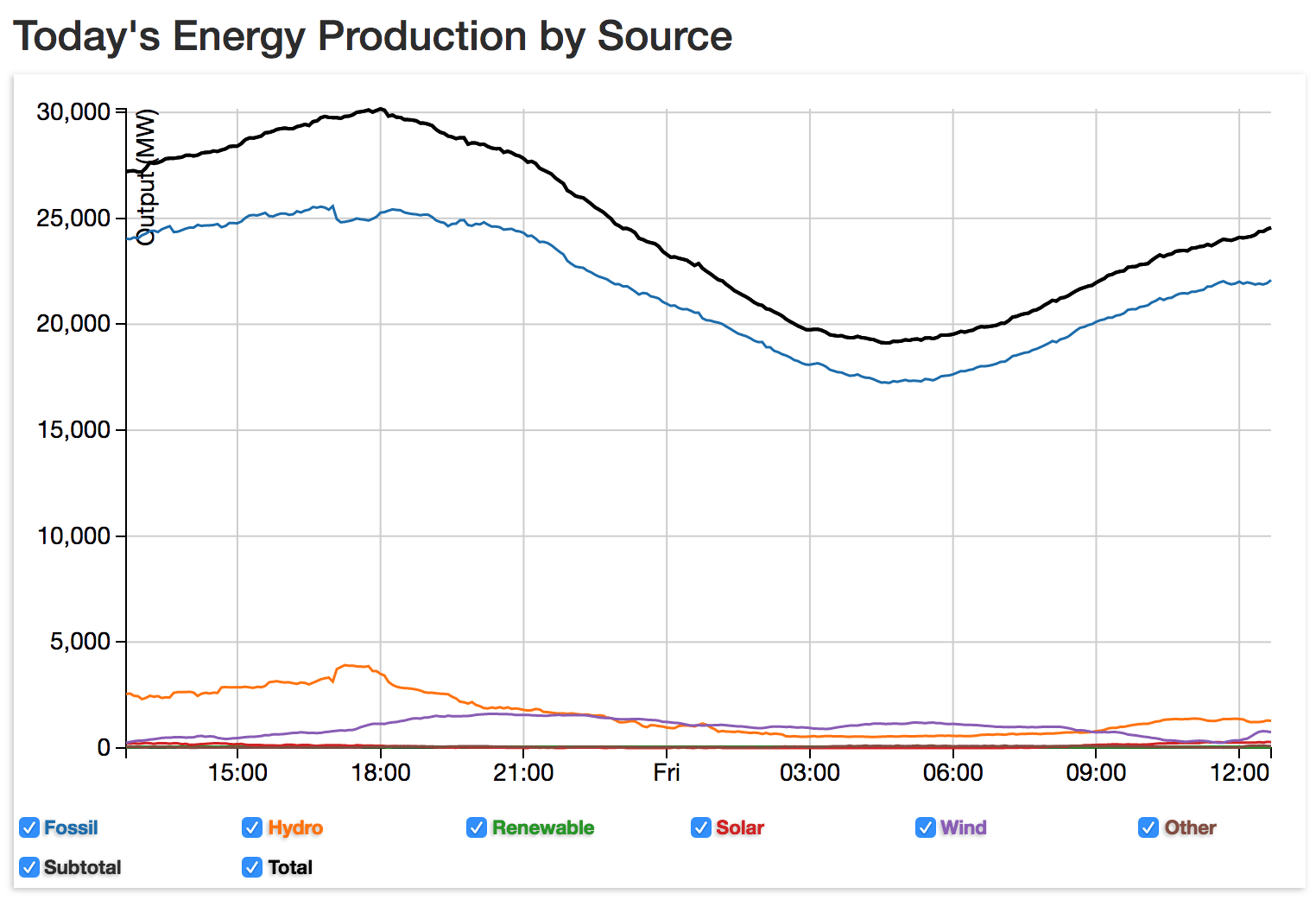

Here's an example snapshot of Australia's electricity production:

The chart above shows how coal and gas dominate our energy mix. Solar barely registers on this scale. And hydro largely moves inversely with wind providing dispatchable backup when the wind dies down.

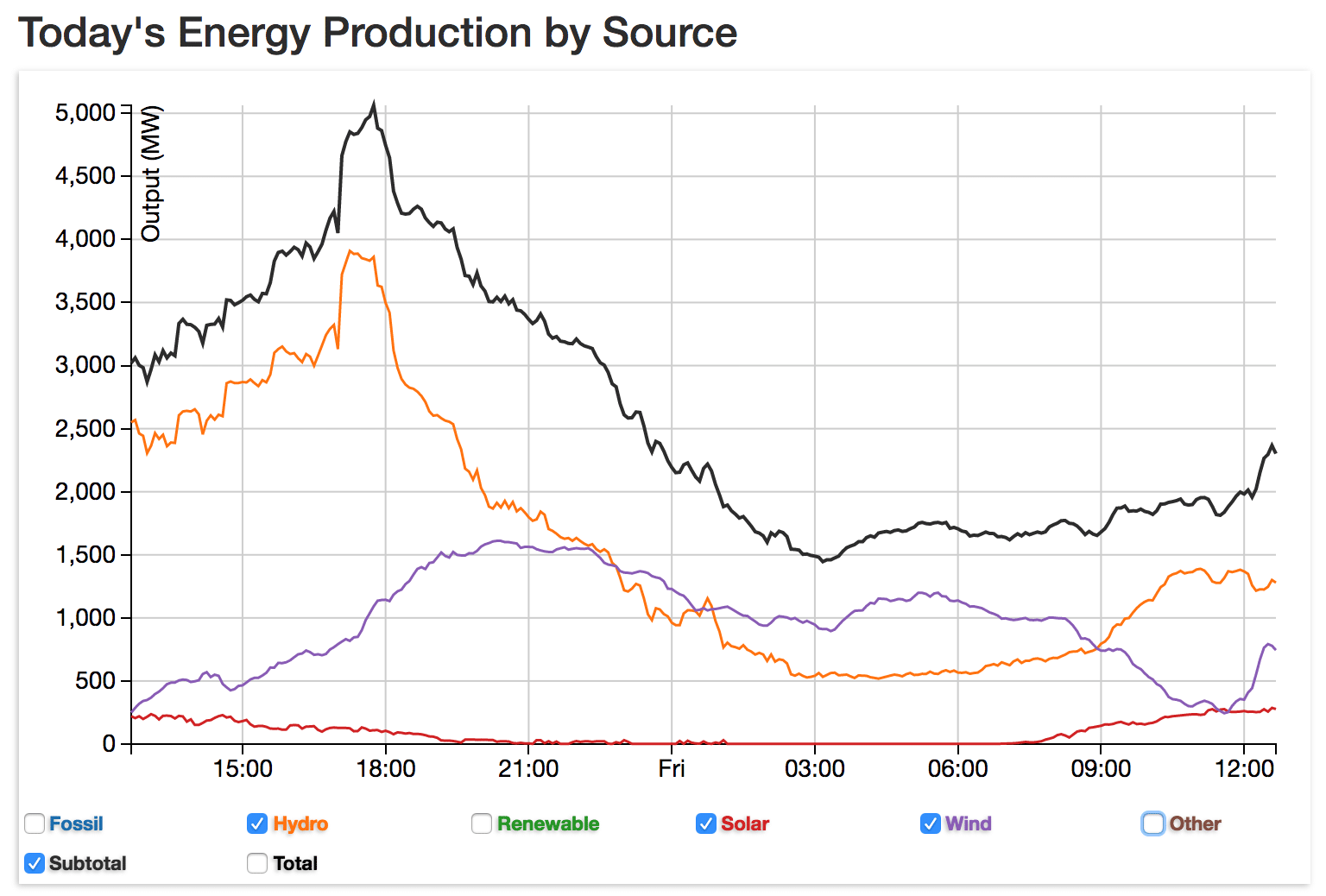

But we need to zoom in to see how this looks:

As you can see, between 15:00 and 18:00, when demand (and therefore total production) is high, wind output was as low as 500MW and barely topped 1100MW. Luckily hydro stepped in to deliver almost 4,000MW, dropping by 21:00 as the wind picked up and demand dropped off by some 4,000MW.

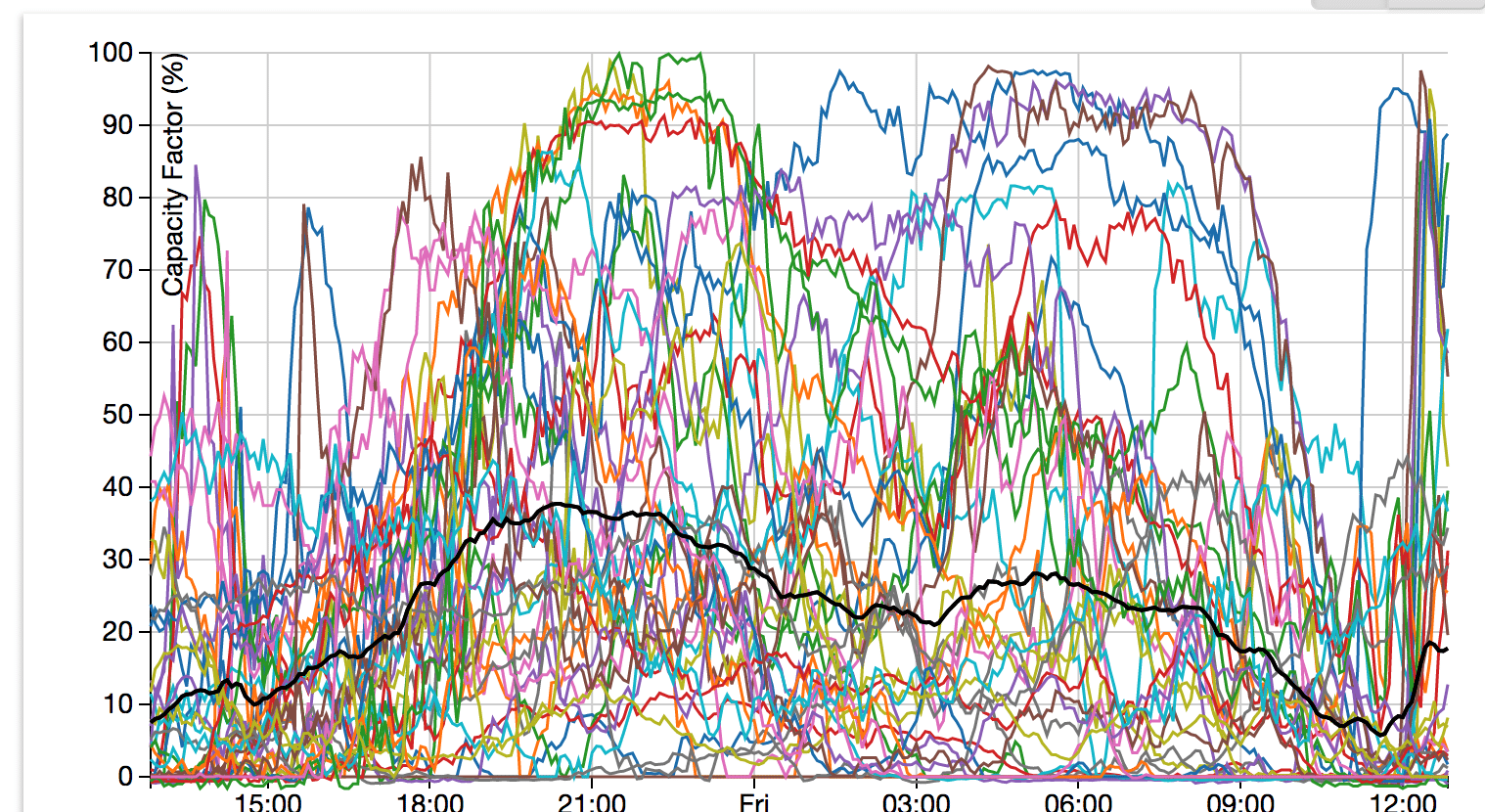

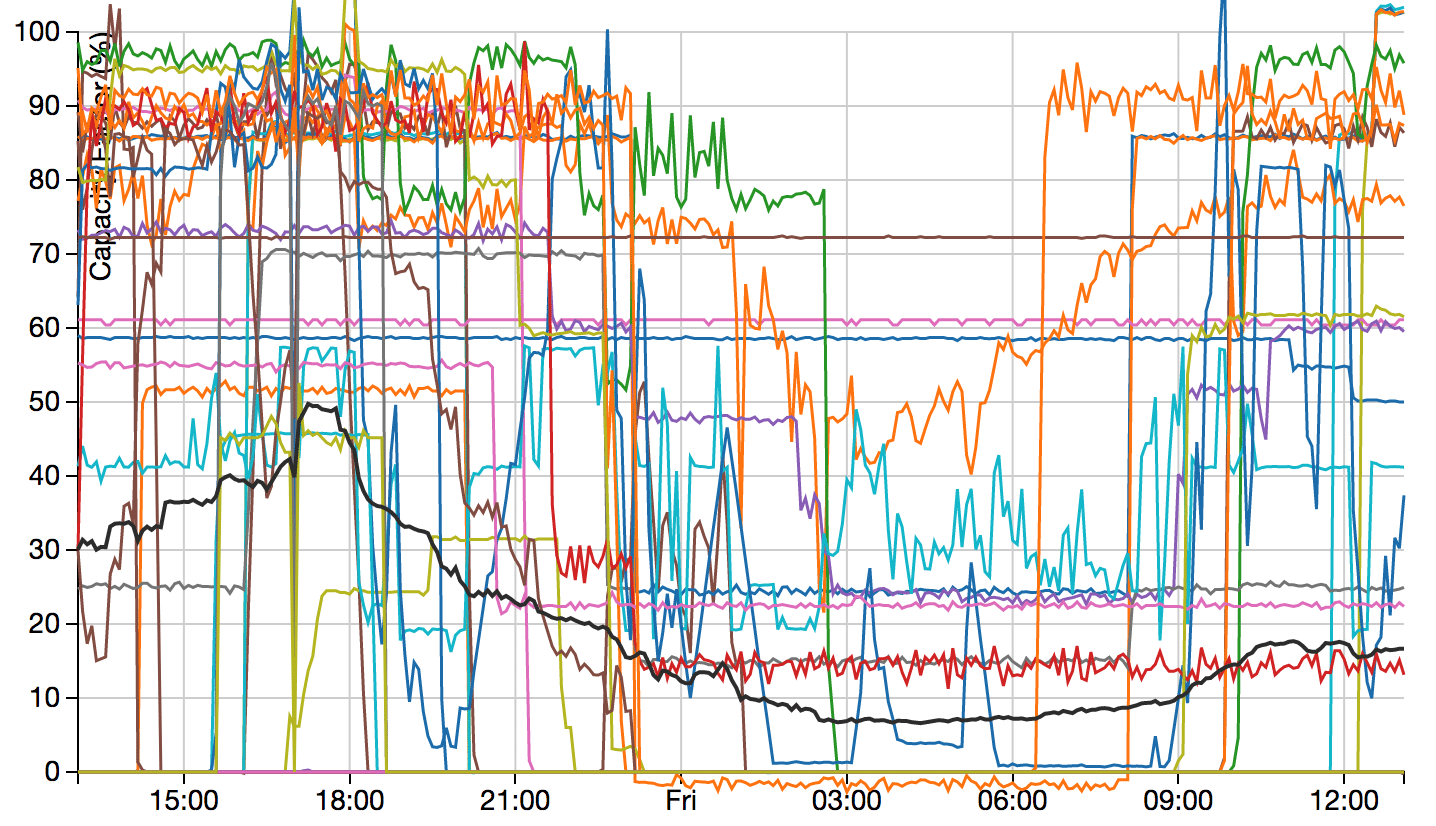

Drilling down to wind production, we see huge intermittency:

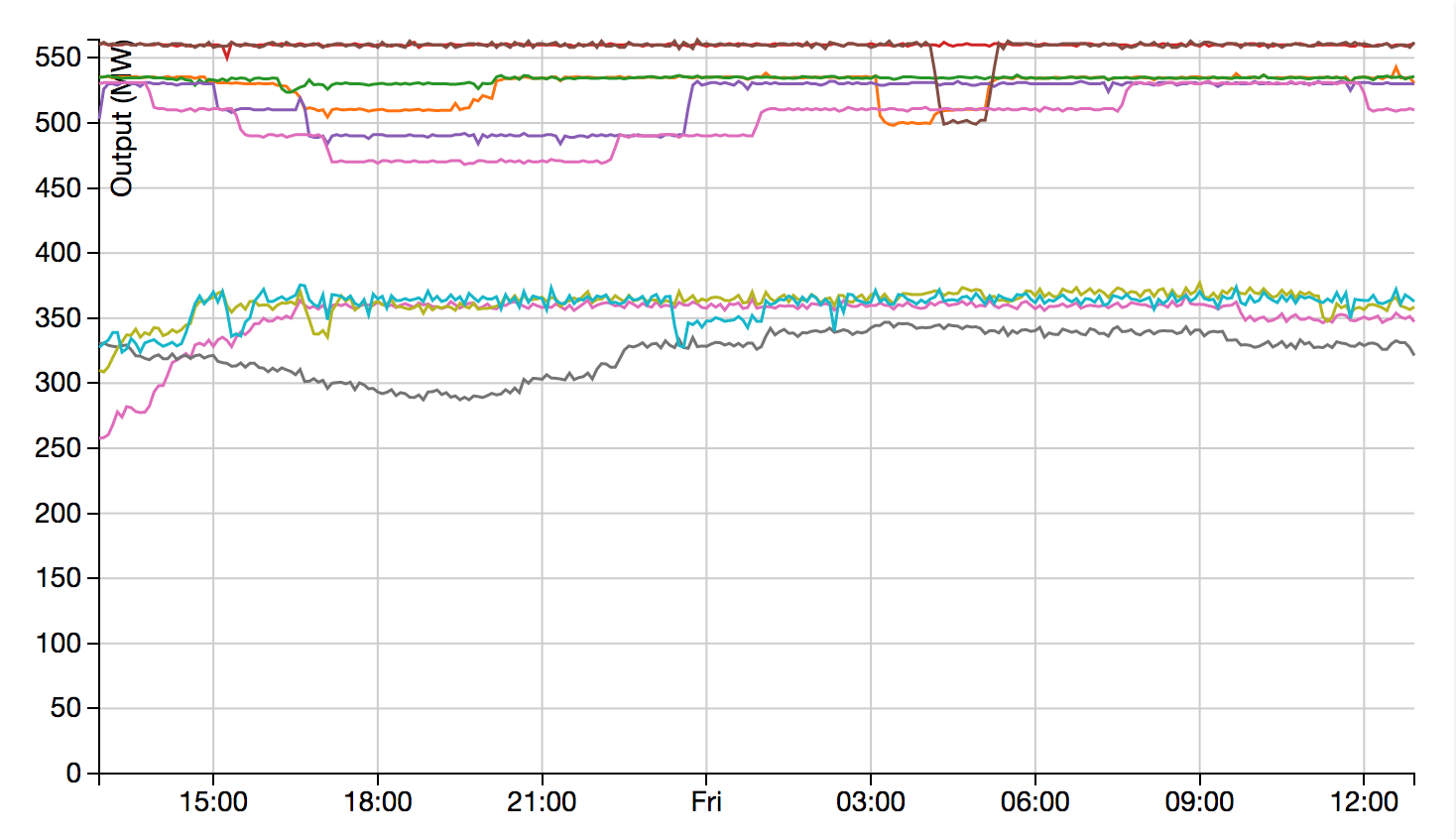

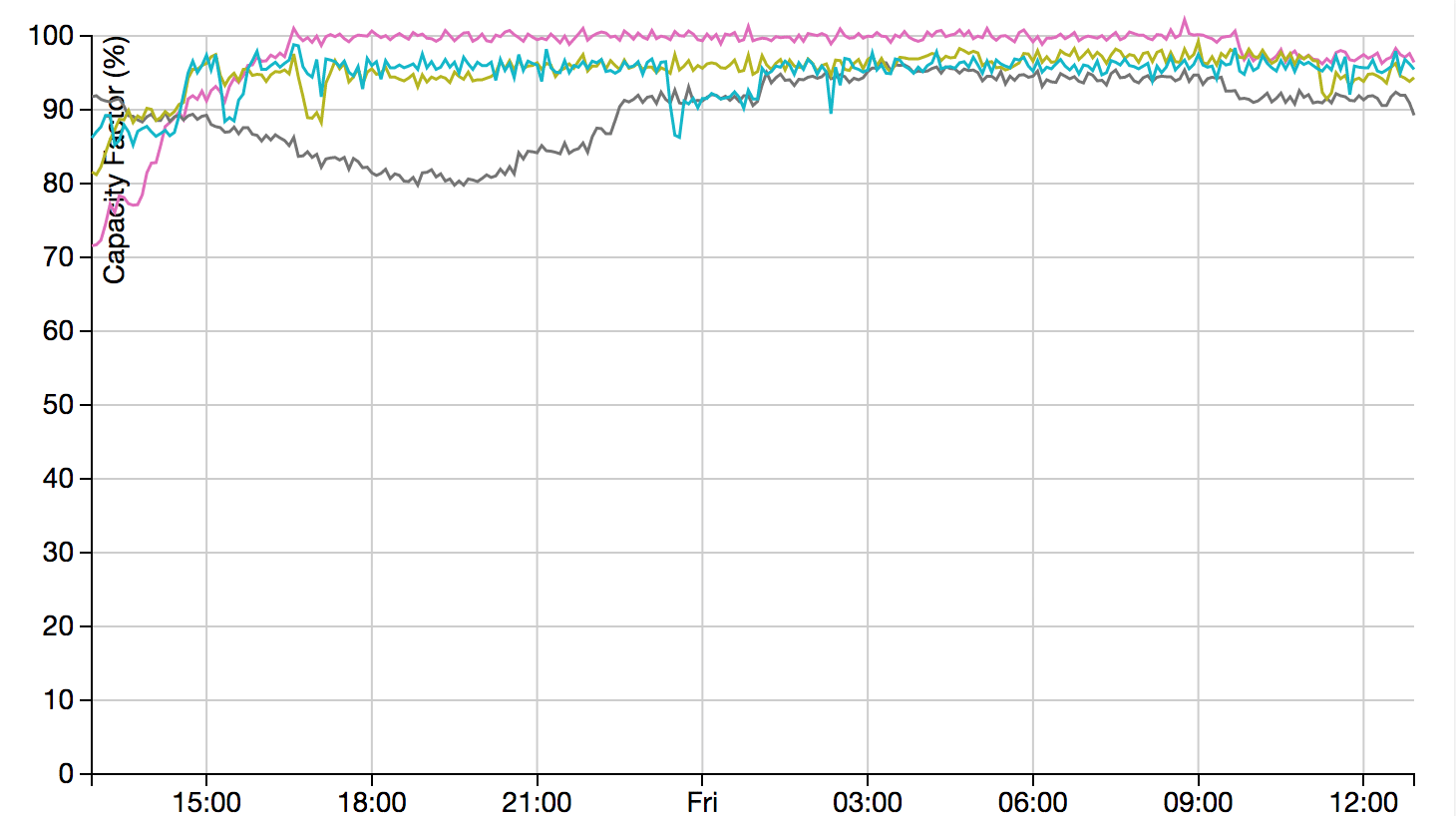

This is in stark contrast to brown coal power stations in Victoria:

The top part of the chart tracks Loy Yang A & B and the lower part of the chart tracks Yallourn's four generator units.

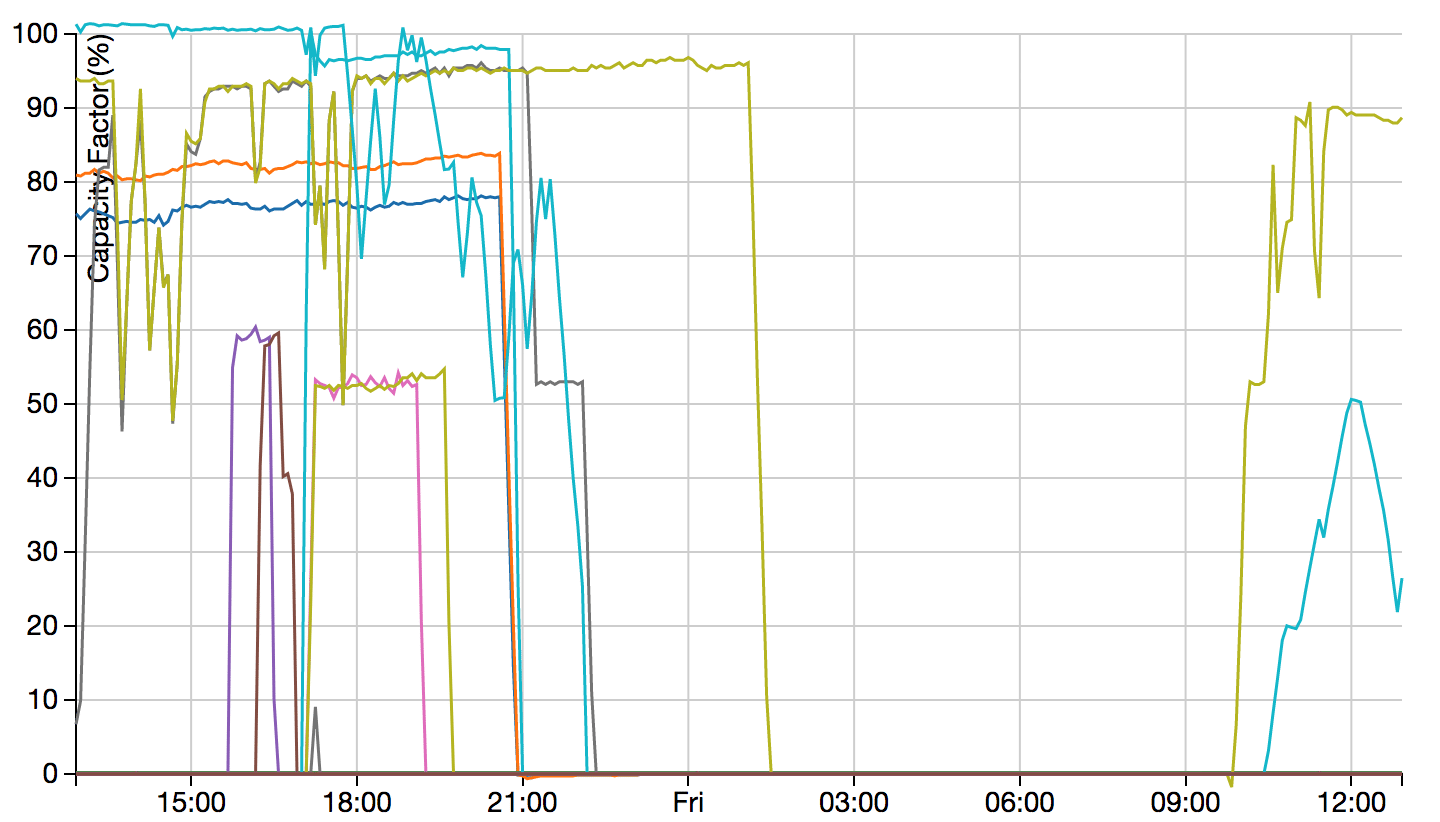

In terms of capacity factor, Yallorn looked like this:

Coal-fired power can deliver reliable, affordable electricity, but it does so by turning on and staying on for extended periods. It can change its output, but it takes time.

On the other hand, gas-fired plants can switch on and off relatively quickly:

Hydro is also quick to turn on and off:

This makes it the only dispatchable renewable source... assuming the dams are full enough.

The point of these charts is to give you an idea of the different scales and operating nature of the main technologies in our energy mix.

And by understanding how coal operates, we can then understand that if the RET mandates 40% wind and solar by 2025, power companies will have to buy that electricity first, ahead of coal power. This distortion results in the withdrawal of reliable, affordable baseload, contributing to higher prices and price volatility through reliance on gas to fill the gaps in wind generation.

And unlike the US, which has experienced a glut of shale gas, bringing down its domestic gas prices, Australia's gas prices are high and climbing.

Anyway, back to the crux of the article.

Yallourn is seeking to continue operations for the next 14 years, mindful of the market distortions caused by programs like the RET.

We look forward to Yallourn's continued operation and the opportunity to develop a Coldry demonstration plant at their site if the market conditions permit and to potentially add further value by enabling further applications for Victoria's world-class brown coal resource.

Read more below...

Energy Australia asks Andrews government to extend Yallourn license

Herald Sun ($) | 13 January 2017 | Tom Minear

THE Andrews Government is being asked to extend the licence for Australia’s second-largest coal mine amid growing doubts about whether its renewable energy target will force the mine to shut down.

Source ($): Energy Australia asks Andrews Government to extend Yallourn license | Herald Sun