Investor News

HiSmelt not a threat to HydroMOR

We’ve noted increased interest in an iron-making process known as HiSmelt, which appears to have recently been revived in China.

Some shareholders have asked us for our thoughts on HiSmelt and how our own HydroMOR process compares.

Comparing technologies can be difficult due to a lack of reliable, sufficiently detailed, publicly available information, so this is by no means a complete assessment.

In general, technology commercialisation can be a long and expensive road, especially if you’re developing a new iron- or steel-making process.

Typically, it takes an average of 10 years and $100 million to bring a new process to market.

For context, HiSmelt has taken about 36 years and over $1 billion to reach the point where it is claimed to function stably and economically.

We’ve seen some notable failures in the race to develop new processes here in Australia. The two most prominent are BHP’s Hot Briquetted Iron (HBI) plant at Port Hedland and Rio Tinto’s HiSmelt plant at Kwinana.

The driver for their development resulted from a requirement to establish a downstream mineral processing plant in return for mining approvals by the Western Australian government.

When it finally closed in 2005, BHP had lost a reported $2.5 billion on its HBI plant. In addition to process problems and safety issues, reports identified various elements of the design and development process that had resulted in out-of-spec products.

And while the BHP HBI case study is interesting, this article is about HiSmelt.

Besides government policy, what drove HiSmelt development in particular? Apparently, Rio had a lot of high-phosphorus iron ore. Removing phosphorus via traditional methods was uneconomic then, and HiSmelt promised to liberate $30 billion worth of this otherwise stranded resource.

HiSmelt development went through several scale steps, with a one-tonne per hour plant being built in the mid-1980s. Rio (then CRA) then spent $105 million ($195M in 2017 dollars) developing an 11-tonne per hour plant at Kwinana in 1992. That plant was the basis for research and development for seven years until 1999 when it encountered significant technical issues. As a 2006 article in Forbes mentions:

Trials at the second plant lasted for seven years until 1999, during which HiSmelt hit a wall. Its original design was for a horizontal furnace, but that design didn't scale up well. The engineers substituted a water-cooled vertical design that performed as promised, delivering a continuous flow of pig iron at 2,600 degrees Fahrenheit (1426°C).

The article doesn’t mention that our very own Keith Henley-Smith was the man who first advised Rio to change the orientation of the HiSmelt furnace.

This eventually resulted in a sufficiently stable operation, which led Rio to attract three new investors into a joint venture to develop the process to an 800,000 tonne per annum plant at a cost of $1 billion; Nucor took 25%, Mitsubishi 10%, and Shougang Steel 5%.

As the Forbes article highlights, the aim was to produce ‘pig iron’ at a 20% saving compared to traditional blast furnace production, but plant stability and economics didn’t pan out as hoped.

By 2008, Rio had written off most of the plant's carrying value, most of the 130 employees had been made redundant, and the plant had been put into ‘care and maintenance’ mode.

The decision to shut down completely was made in 2011, driven by the ongoing technical issues and poor economic outlook.

Rio then signed an agreement in 2011 with Indian steel maker JSPL to sell the HiSmelt plant and relocate it to Orissa.

After announcing the India deal (but making little subsequent progress), Rio signed a new deal with a Chinese consortium.

While Rio has been silent on how much of the $1 billion research and development investment it has been able to salvage, the move to China seems to have resulted in the resurrection of HiSmelt following further process development.

So, how does HiSmelt compare with HydroMOR?

A source quoted in a recent LinkedIn post (since removed), who claims to have had recent direct experience with the HiSmelt project in China, says HiSmelt is on par with blast furnace cost of production in China.

Originally, HiSmelt was projected to be 20% cheaper than blast furnace production in Australia.

This gap indicates that the process has not met its original performance parameters. Given that HiSmelt uses lower-cost thermal coal in place of metallurgical (coking) coal and iron ore fines in place of premium lump iron ore, this suggests that HiSmelt’s capex and non-feedstock opex may be higher than for a blast furnace.

The source also accounts for the challenges encountered in achieving steady-state operation.

As mentioned, publicly available data on the cost of HiSmelt is difficult to find. We only have this anecdotal reference that suggests it is on par with a blast furnace, which we assume is in the context of Chinese economic and labour market conditions.

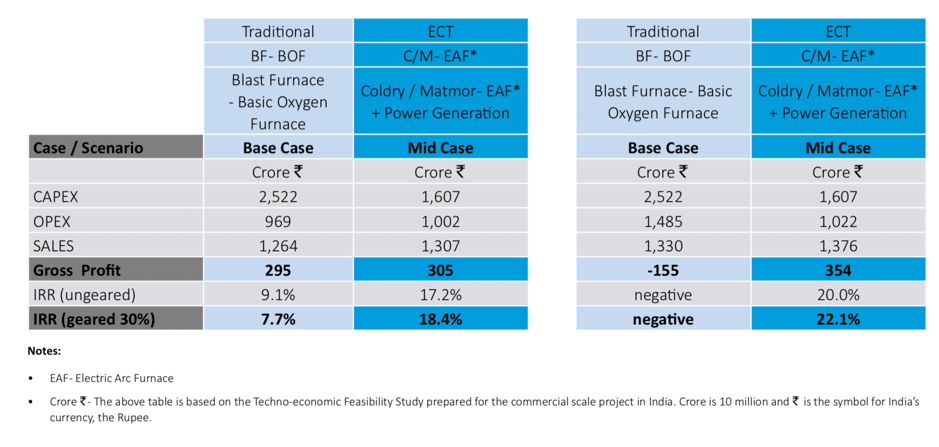

As part of developing our India project for Coldry and HydroMOR, we conducted a Techno-Economic Feasibility (TEF) Study with NLC and NMDC. The study indicated a better IRR for a new HydroMOR facility than a new Blast Furnace, so it may also be the case compared to a new HiSmelt plant if the above source is accurate and our R&D outcomes match projections at subsequent commercial scale.

In December 2017, we provided the market with an update to our TEF financial snapshot to illustrate HydroMOR's advantage of being decoupled from iron ore and coking coal price increases.

The chart above left shows the compelling IRR for the proposed 500,000 tonnes per annum HydroMOR plant compared to a new Blast Furnace of the same capacity. The prevailing price of coking coal and premium lump ore in early 2016 was at a low. The chart above right shows the improvement in the business case for HydroMOR as traditional blast furnace input costs returned toward historical averages, driving BF IRR into negative territory despite corresponding firming iron prices. Since then, the gap between premium lump iron ore and fines has widened and coking coal pricing has increased, further improving the case for HydroMOR.

In short, we believe that following successful research, development and commercialisation outcomes, HydroMOR will be a better choice than HiSmelt in markets with lignite for the following reasons:

- Lower operating temperature: Lower temperature typically means lower capex, higher efficiency and lower operating cost

- Less complex furnace and auxiliary equipment design: Lower complexity typically means lower capital cost and lower risk of faults, downtime & repairs

- Lignite: HydroMOR can use the cheapest coal, lignite, resulting in lower raw material costs

- Lower CO2 emissions: HydroMOR is expected to emit significantly less CO2 than HiSmelt, but it’s difficult to quantify with the limited available data.

We have no doubt HiSmelt will be considered for deployment in places like China where the right combination of raw materials is available and where the economics are equal to or cheaper than alternatives. We believe the same rationale will apply to HydroMOR in locations with lignite and iron ore or iron oxide waste, such as millscale and nickel tailings.

China has over 7 billion tonnes of proven lignite reserves, and past interest in HydroMOR, subject to its demonstration at scale, makes it a highly attractive and prospective market.

Any comparison should also consider the issue of process complexity. In the above LinkedIn article, the writer highlights the consequences for HiSmelt of a simple pump failure, resulting in significant downtime to return the furnace to operation. By contrast, a failure in any component of the HydroMOR furnace simply results in the discharge of the material, repair of the faulty component, and return to service.

To summarise:

HydroMOR is the only lignite-based iron-making process we are aware of. HiSmelt can’t use lignite and, as such, is not a direct threat to HydroMOR in providing a solution for lignite resource owners.

Following commercialisation, we expect HydroMOR will allow customers to decouple from the metallurgical and thermal coal markets, increasing resource diversity and security. HiSmelt is tied to the thermal coal market.

We anticipate HydroMOR's unique features will result in such benefits as lower capital intensity and operating expense compared to HiSmelt, providing a convincing business case for broad adoption in markets with cost-effective access to appropriate lignite reserves.