Investor News

Quarterly Report & Appendix 4C

Highlights during quarter

Projects

- Strategic review adds focus to Coldry project execution

- Coldry project on track to commence commissioning in Q1 CY22

- Full feasibility launched for Net Zero Hydrogen Refinery project (“Headline Project”)

- Federal Govt H2 Hub Implementation grant submission completed showcasing Headline Project, partnered by GrapheneX

- Letters of support for grant submission from Vic State Government, Energy Australia, Coregas, Latrobe City and Federation University (plus others)

- Headline Project “feasibility pack” created to engage project partners, debt providers and equity markets

- Property purchased at Yallourn, Victoria as site for Headline Project.

Finance

- ~AU$1.968M low interest R&D loan received from InvestVictoria

Corporate

- Delivered Peer-Best-Practice ESG reporting

- Appointed new Joint Company Secretaries

- AGM held with all resolutions passed with >95% majority votes

Highlights subsequent to quarter

Projects

- Carbon credentials of Headline project reviewed against legislation

- GHD engaged to commence approvals and project planning program for Headline Project

Other

- First patent granted for HydroMOR, a process to deliver lower emission, lower cost, metal production

- Wood247 pilot business to be divested after 6-month trial to focus on headline projects

Quarterly Activities Overview

1. Coldry Commercial Demonstration Plant (“Coldry Project")

Following the Board restructure in September 2021, the new Board then undertook a strategic review to capitalise on the increasing government and industry interest in net zero-emission technologies. Subsequently, at the end of the quarter in October 2021, the Company announced a renewed focus on formalising project partner relationships. As part of the review, the Board also decided to pause works on Phase Two of the Project to enable ECT to better direct capital towards the accelerated and large-scale commercialisation of its proprietary Coldry technology and maximise shareholder value in this fast-evolving sector.

Despite the impact of COVID-19 restrictions in Victoria during the quarter, ECT was able to advance construction activities at its Coldry Project in Bacchus Marsh, with construction progressing, on schedule for commissioning in Q1 CY22.

The Coldry technology is positioned to play an important role in transitioning to a net zero-emission industrial energy sector and provides technology support to associated government policy development. In addition, the pending completion of this facility will enable the Company to demonstrate its unique, low cost, zero-emission Coldry lignite drying technology at a commercial scale to potential downstream partners and support the development of the larger proposed net-zero hydrogen refinery project in Victoria’s Latrobe Valley.

Managing Director Glenn Fozard commented:

“The company is being supported by a dedicated group of staff at our Bacchus Marsh site whom are performing well in the face of significant COVID related headwinds. The current COVID situation, along with supply chain delays and a very tight skilled labour market are presenting serious challenges which are being more than met by our construction and project management team. It’s exciting to see our plant on track for commissioning and we look forward to demonstrating production of our first Coldry pellets from this assembly over the coming months.”

A detailed update will be posted to the Company’s website shortly.

2. Net Zero Emission Hydrogen Refinery (“Headline Project”)

As a result of the strategic review undertaken by the Board in 2021, ECT started full feasibility for a Net Zero Emission Hydrogen Project, using the Federal Government’s H2 Hub Implementation grant as the focal point.

ECT received support from potential partners and stakeholders including Victoria State Government departments, Energy Australia, Coregas, Latrobe City and Federation University, and submitted the grant application jointly with GrapheneX on the 22nd of November 2021.

ECT continued to develop the feasibility program of the Headline Project which also saw the company complete the purchase of a suitable project site at Yallourn, Victoria, in close proximity to Energy Australia’s Yallourn power station and lignite mine as well as the T15/16 outfeed lignite terminal that ECT is co-developing with Energy Australia.

Subsequent to the quarter, the company engaged engineering firm GHD to start the approvals planning process, covering EPA works approvals and licensing, as well as local government planning application requirements. Additionally, GHD will commence process modelling activities in preparation for engineering development works.

ECT will now distribute the project feasibility pack amongst potential debt providers, project and equity partners, as well as investment market professionals.

More broadly, bipartisan support from state and federal governments to develop Australia’s domestic and export hydrogen capability continues to gain momentum with a range of initiatives intended to position Australia as a future leader in hydrogen exports. ECT’s participation in the Gippsland Region Hydrogen Cluster (GRHC), as well as its membership of the Heavy Industry Low-carbon Transition Cooperative Research Centre (HILT-CRC) and the Future Energy Exports Cooperative Research Centre (FEnEx-CRC), increases industry and government awareness of the Company’s net zero-emission technologies. In addition, it has the potential to open numerous downstream opportunities for ECT.

The Company continues to investigate opportunities to access government support and industry partnerships.

Group Engineer, Ashley Moore commented:

“Following the submission to Government of our grant proposal, we performed detailed assessment of the project against ‘National Greenhouse and Energy Reporting’ (NGER) protocols. This resulted in a net-negative CO2 emissions position, which is a great place to build from. We expect to see further improvement in the emissions profile once the benefits of AgChar on soil health, productivity and atmospheric carbon absorption are considered. ECT is very excited about this project and its potential.”

3. Corporate & Finance

As part of the corporate restructure undertaken in the prior quarter, ECT appointed new Joint Company Secretaries on the 13th of October 2021. Mr Arron Canicais and Mr Kian Tan of Small Cap Corporate Pty Ltd were appointed as joint Company Secretaries and replaced Mr Adam Giles, who the Company thanks for his service in this role.

In late December, the Company held their Annual General Meeting, which saw all 22 resolutions passed at greater than 95% votes in support.

During the quarter, the Company established an AU$1.968M low-interest R&D loan with InvestVictoria with AU$1.18M drawn in December. The remaining undrawn balance on this facility is AU$788,000 and is scheduled to be drawn in late February. The Company subsequently finished the quarter in a strong position of $2.13M with focus shifting from equipment purchase to equipment installation at Bacchus Marsh.

Subsequent to the quarter, the Company made the decision to divest the Wood247 pilot retail business and focus on its headline projects in Bacchus Marsh and Yallorn. The details and background for this decision are outlined in the ASX announcement released on 17 January 2022.

In late January, the Company also received notification of the granting of its first HydroMOR patent in the jurisdiction of Russia, which is due to be issued shortly. The HydroMOR process offers an alternative to conventional CO2-intensive blast furnace steelmaking, enabling the use of lower-cost, abundant lignite in place of higher-cost coking coal, delivering a lower emission, lower cost, metal production process. The Company remains excited about the potential industrial applications for this technology.

The table below outlines the status of the various international patent applications for HydroMOR.

International Patent Application Status - HydroMOR

| Case Ref. | Country | Case Status |

|---|---|---|

| 35519103 | India | Response to Exam Report Filed |

| 35526602 | Australia | Exam requested |

| 35526603 | Canada | Application filed |

| 35526604 | China | Response to Exam Report Filed |

| 35526605 | European Patent Office | Response to Exam Report Filed |

| 35526606 | Russian Federation | Accepted |

| 35526607 | United States of America | Examination report received |

| 35527133 | Indonesia | Response to Exam Report Filed |

| 35540529 | Hong Kong | Application filed |

4. ESG Reporting

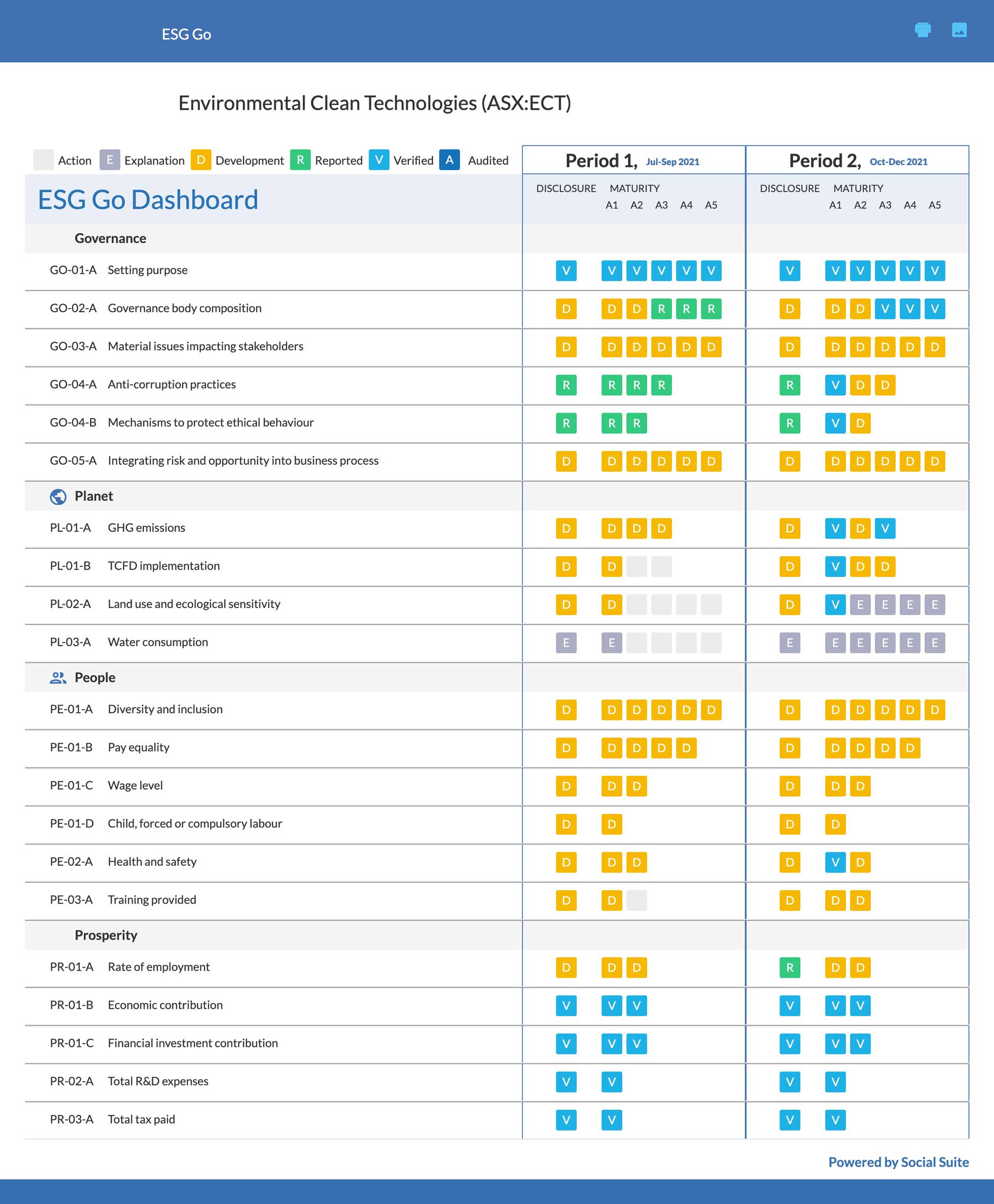

ECT continues to be assessed by, and report to, the ESG framework under the World Economic Forum (“WEF”) Environment, Social and Governance (ESG Metrics).

The Company has decided to take a best-of-peer approach to ESG and over the reporting period has initiated the following key developments in support of our continued commitment to the WEF Pillars of Governance, Planet, People and Prosperity, and associated 21 core ESG metrics:

- ECT has engaged a dedicated ESG Advisor.

- ECT has set a net-zero target (Scope 1 and 2 Greenhouse Gas (GHG) emissions) for ECT’s corporate offices (plus limited Scope 3 emissions to include staff land and air travel, and waste), with a target completion date of the end of the current financial year (i.e., FY22).

- To ensure consistency with larger potential partners, ECT is investigating early disclosure of climate risks in alignment with the recommendations of the Taskforce on Climate-Related Financial Disclosures (TCFD), as it relates to both physical and transition climate risks (and opportunities). In parallel, the Company is continuing to embed key ESG risks measures (especially climate-related risks and opportunities) into the Company’s Enterprise Risk Management (“ERM”) process.

The ESG Dashboard below (provided by ESG technology partner, Socialsuite) provides a snapshot of the Company’s progress from the end of the previous quarter to 31 December 2021.

Full details of the quarter’s ESG progress and achievements are detailed in the Company’s report, ESG Highlights Q2FY22, which can also be found on the Company’s ESG web page: www.ectltd.com.au/esg.

Managing Director Glenn Fozard commented:

“Given our core business is the delivery of net-zero emissions solutions, we believe it is vital for us to maintain the highest standard practicable for our peer group. To this end, we aim to align our GHG and TCFD to ASX300 standards, as we see this as an inevitable compliance standard into the future. This also helps our larger partners better understand how ECT’s principles, values, and enterprise risk management aligns with their own, through transparent and regular disclosure.”

“Against the market’s claims of ‘Net Zero in 2030 or 2050’, ECT lives the mantra of ‘Net Zero Now’, and as such, aims to lead our peers towards a more sustainable future in business and industry.”

5. Commentary to Appendix 4C

Approximately $594K (prior quarter $943K) was spent on the Coldry Project during the quarter, including property, plant and equipment purchases, as the Company nears the completion of Phase 1 of the Coldry demonstration plant. This figure is down on the prior quarter as the focus turned to installing equipment already purchased in prior quarters.

Research and development costs were significantly down on the prior quarter by $485K as the preceding quarter included the cost to secure coal supply from EnergyAustralia at the Yallourn coal mine.

The prior quarter included cash receipts of $3M from the issue of promissory notes, the majority of which have been converted to equity following shareholder approval which was obtained at the Company’s AGM in December 2021.

The Company received its 2020/21 income tax return refund, which included the R & D tax incentive of $1.9M. Approximately $1.3M of this was used to repay the Company’s R & D loan facility.

The Company has a loan facility with Invest Victoria of $1.968M, of which $1.18M was drawn down in the December 2021 quarter. Undrawn loan facilities are $788K. The ability to draw down these funds is dependent on the Company demonstrating that its expected R & D incentive for the year ended 30 June 2022 will be greater than the amount drawn on the loan using a loan to value ratio of 80%.

The Company’s cash receipts, manufacturing and advertising costs were all reduced compared to the prior quarter. The majority of these cash inflows and outflows are related to the Wood247 business. In addition, as previously announced, the Company has commenced the process of divesting from this business and as such related activities were reduced.

Payments of $98k to related parties of the entity include payments for directors’ fees to executive and non-executive directors and payments to executive directors.

Under section 8.5 of the Appendix 4C the Company reported “N/A” for the number of quarters of cashflow remaining, because of the large inflow of $1.898M from the R&D Tax Incentive refund leading to a positive net operating cash flow. Adjusting for this one-off inflow, the underlying cash burn was $860k. On that basis, there are approximately 3.5 quarters of available cash flow given the total available funding on hand of $2.92M.

// END //

This announcement is authorised for release to the ASX by the Board.